In this report we consider ways in which we can reduce stress and boost workplace engagement to help improve UK productivity.

We present new analysis of Understanding Society, a longitudinal survey of 40,000 households across the UK. We examine how stress affects workers, reducing productivity, and how low financial resilience is a substantial contributing factor.

The UK has a significant productivity problem. We’re at least 25% less productive than the major economies we compete with. There’s been plenty of discussion of the big factors behind this – our relatively weak capital investment, skills shortages and poor infrastructure. But to fix each of these requires substantial investment and long-term political engagement. Other, less prominent factors, like engagement among our workforce, could provide a useful boost to productivity while we’re waiting for action on the big issues. Experimental trials prove that making people happy can increase productivity by 12%, and that lower happiness is systemically associated with lower productivity.

We work harder and achieve more when we feel like we have control over what we do, and find it rewarding. We do better in jobs that we like. But many industries have seen job satisfaction decline over the past decade. The public sector, administration & support services, real estate, accommodation & food services & retail have seen particularly sharp falls. Never mind struggling to make the big decisions necessary to keep the UK economy competitive, we’re not even making the most of the skills and talents we do have thanks to a lack of engagement.

Workplace stress

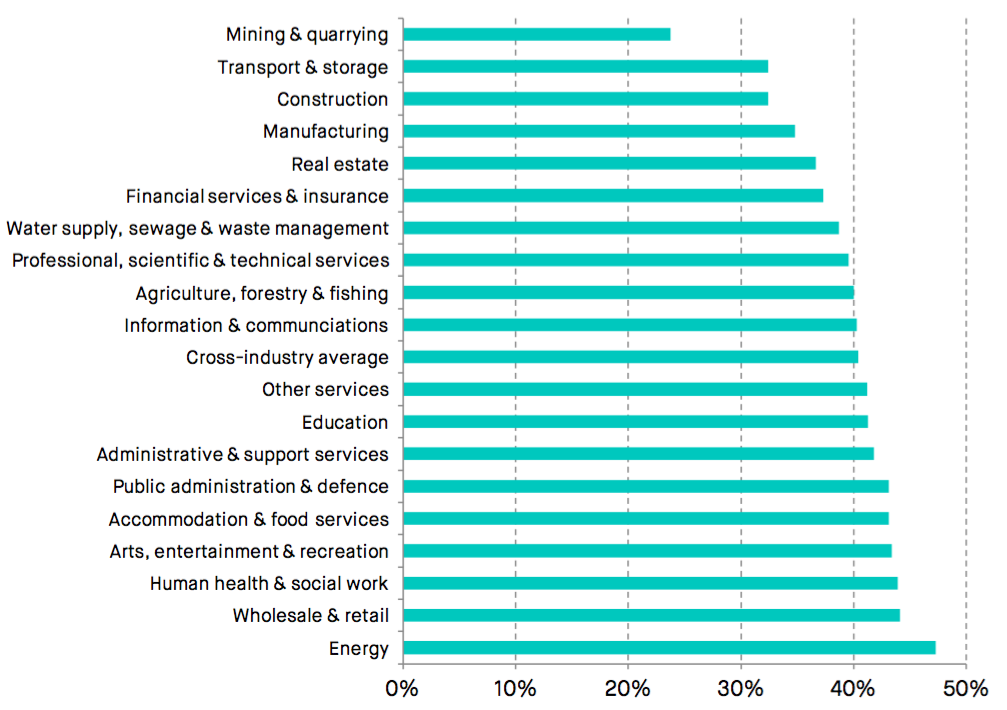

Nearly half of all workers (40%) experience at least one form of stress which could reduce productivity, for example a lack of concentration or loss of sleep (see Figure A).

- More than one in three workers (34%) achieve less than they would like due to poor mental health.

- A third of workers (33%) have carried out their jobs less carefully than usual due to mental health issues.

- One in six (16%) struggles to concentrate at times due to stress or other worries.

Figure A: Proportion of workers in each industry reporting at least one sign of stress which could impede their performance at work

Source: SMF analysis of Understanding Society Wave 5, 2013/14. Includes all those with a job who report at least one of the following: Mental health meant less accomplished than usual over the past four weeks; undertaking work or other tasks less carefully than usually at least some of the time in the last four weeks; concentrating less than usual and; losing sleep over worries more than usual.

Financial Fragility

Our new analysis shows that low financial capability and resilience is a significant cause of stress across the UK workforce. This is one area where every employer, regardless of size, has an existing relationship with their staff, and could potentially reduce stress and improve productivity.

- One in 12 workers are finding things financially difficult. And nearly a quarter of workers say they’re just about managing – suggesting they could quickly find themselves in serious financial difficulties if they become unwell, are bereaved or made redundant.

- This low financial resilience is a problem across industries – and it’s getting worse. The proportion of workers reporting that they face financial difficulties nearly doubled over the decade to 2013/14.

These money worries have a clear impact on how people feel and behave as they go about their day-to-day lives and jobs.

- Four in ten workers say money worries have made them feel stressed over the last year.

- A quarter (25%) say they have lost sleep over money worries.

- One in eight workers (13%) report that money worries have affected their ability to concentrate at work.

- One in twenty workers (6%) has missed work in the last year due to money worries.

When we look at the financial situation of UK households, we quickly uncover the financial vulnerabilities behind these money worries. Even 10 workers in relatively well-paid industries often have low levels of savings and lack financial resilience.

- More than half of workers would be significantly worried about a large unexpected expense.

- Nearly 50% of workers (48%) are not putting any money aside for anything more than regular bills.

- Nearly a third of all workers (29%) have no savings or investments at all.

The UK’s workforce lacks financial resilience. It’s clearly affecting our ability to concentrate at work and blunting our productivity.

What can we do?

Some firms have tried to reduce workplace stress and improve productivity in novel ways, like allowing pets in the office, giving employees unlimited holiday or providing nap pods. For many businesses, however, these simply wouldn’t be practical. Here, we look for alternative interventions that could help businesses across the economy and the public sector to boost productivity.

Employers always have an impact on the financial wellbeing of their workforce as the primary source of income for most people. And as poor financial resilience affects all income groups, the answer isn’t just higher levels of pay. Instead, employers need to help their staff to learn healthy financial behaviours and build financial resilience.

We’re already using workplace pensions to build financial resilience later in life. One option is to extend auto-enrolment policies to include short-term savings or income protection insurance as well as pension savings. But auto-enrolment programmes are difficult to design and take a long time to organise. The government may want to consider other ways it can encourage employers to provide income protection insurance or short-term savings,

But offering financial products is an increasingly complex business, and many firms wouldn’t know where to start. New financial mutuals, providing affordable savings and credit products using bonds of trust between those in particular professions, could be one way of building a culture of financial resilience through the workplace.

Tax incentives are already offered on some workplace savings and investment programmes, but only the largest employers are usually able to make these schemes available to their workforce. Extending these privileges to new workplace savings schemes would increase the number of workers who can benefit and maximise the number of households able to build financial resilience by saving through their payroll. Firms could also consider simple changes, like printing a recommended monthly savings goals on payslips or offering budgeting applications alongside online payroll to help improve the financial capability of their teams.