• More than two thirds of UK 50–64-year-olds don’t know how much they'll need for retirement

• Only a fifth of 50–64-year-olds have spoken to a financial adviser about their pension

• Only 14% of people accessing a defined contribution pension pot for the first time seek free guidance from Pension Wise

A clear majority of people approaching retirement don’t get advice or guidance on how to build up and use a pension, leaving many confused, anxious and at risk of missing out on a better quality of living in later life, a new study shows today

The Social Market Foundation think-tank said that gaps in knowledge and understanding of pensions and savings leave many people at risk of making inadequate preparation for retirement or spending pension pots unwisely.

The gap in the provision of good financial advice and guidance risks creating “real financial harm,” the report said, with opinion poll data finding that only 31 per cent of 50-64-year-olds with a pension have a broadly accurate idea of the savings they will need to deliver their desired income.

The SMF report was sponsored by Phoenix Group, a retirement and savings business. The SMF retained full editorial independence.

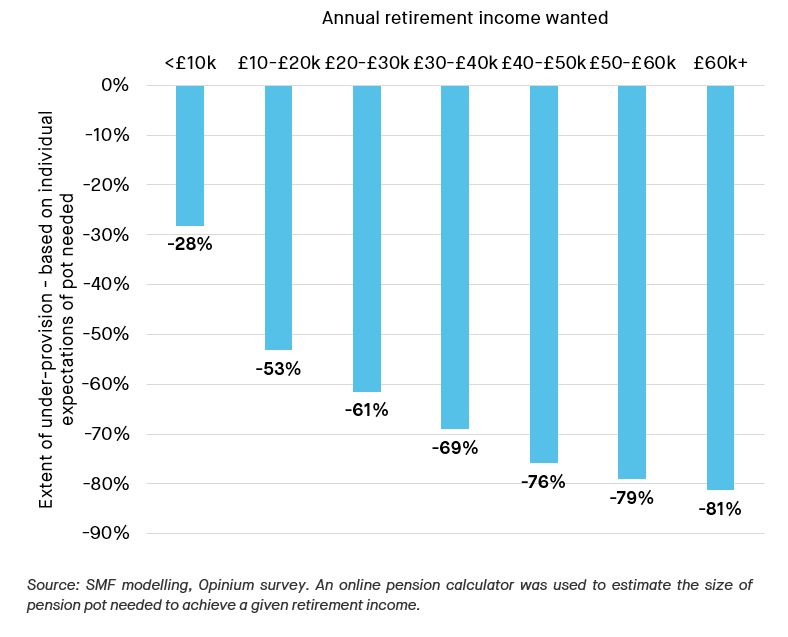

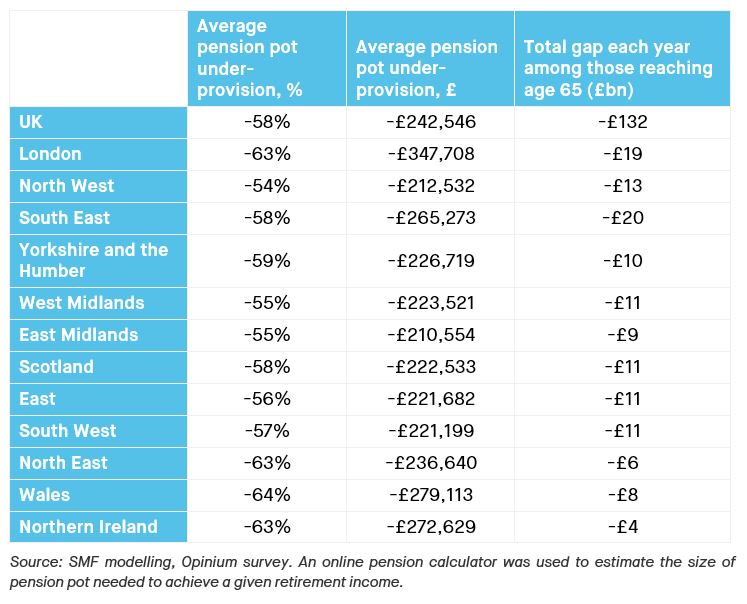

The report also states on average, people approaching retirement age are almost £250,000 short of the pension pot they would need to deliver the pension income they want in later life.

The typical person aged 50-64 has pension savings that are 58% short of what they require, adding up to a total annual savings gap of £132bn across the country for those reaching retirement age. (See Notes)

The SMF research also showed that majority of people don’t access either regulated advice from an Independent Financial Adviser about their pension (only 20% of 50 – 64-year-olds with a pension do) or free guidance available from the government’s Pension Wise service (only 14% of those accessing a defined contribution pension pot for the first time do).

As a result, many lack understanding of how much they need to save or how best to use their pension in retirement, the SMF said. While some people feel very confident about their pension knowledge, many feel anxious and ill-informed.

The move away from defined benefit (final salary) pensions towards defined contribution schemes has and will continue to increase the need for better advice and guidance, the SMF said, since it will only increase the complexity of the pension landscape for many people.

The SMF, a cross party think-tank, called for an overhaul of the rules around providing financial advice and guidance in a new report published at a Westminster debate today. (See Notes for details.)

The report, A Guiding Hand, is based on extensive opinion polling and focus groups with people approaching retirement age. The report was sponsored by the UK’s largest long-term savings and retirement business, Phoenix Group. The SMF retained full editorial independence.

Other key findings on what people know – and don’t know – about pensions:

- Most households do not have adequate knowledge and support in navigating the complex pensions landscape. Only 20% of 50–64-year-olds have spoken to a financial adviser about their pension. Just 14% of those accessing a defined contribution pension pot for the first time use the Government’s Pension Wise service, which aims to provide guidance on pension options, despite this service being free.

- People who do not get advice or guidance don’t know how much they need to save. Only 31% of 50–64-year-olds with a pension have a broadly accurate idea of the savings they need to deliver their desired income. Two fifths (40%) of survey respondents reported not being confident in being able to meet their desired income in retirement, with 14% saying they are not confident at all.

- Getting advice or guidance makes people much more likely to understand the pension savings they need. Half (48%) of people who get advice have a broadly accurate idea of the savings they will need. The same is true of 35% of those that had used Pension Wise.

- Use of financial advice is much more likely than Pension Wise to encourage saving. 23% of people who took advice increased their pension contributions. Only 8% of people using Pension Wise did so.

- While Pension Wise is associated with improved knowledge, using it appears to make little difference to behaviour. Just over half (54%) of individuals that had used Pension Wise reported taking no action as a result of using the service. In contrast, the most frequently given consequence of speaking to a financial adviser about retirement was increasing levels of contribution into a pension pot (23%) and changing investment (20%).

Findings on the barriers to becoming better informed:

- Overconfidence prevents individuals from receiving support. In the Opinium survey, the most frequently cited reason for not speaking to a financial adviser was feeling financially knowledgeable enough to take decisions without advice (28%), with this driven by men (34%) rather than women (22%).

- Lack of awareness about what is on offer also affects usage. Barely half (47%) of those aged 55-64 have heard of Pension Wise.

- Regulatory barriers are likely to be holding back provision of advice and guidance. Ambiguity around Financial Conduct Authority rules on (regulated) advice and (unregulated) guidance is making firms cautious of offering useful information about pensions.

Scott Corfe, SMF research director, said:

“The blunt truth about pensions is that many people don’t know enough to make the decisions that would give them the retirement they want. Poor information will mean poor outcomes for too many people.

There is a serious gap in the provision of advice and guidance around pensions, and that gap leads to real financial harm.

Lacking an accurate understanding of what they will need for the retirement they want means some people will not save enough, and end up disappointed. Not fully understanding their options on the way they use their pension savings in retirement means that some people will not make the best use of that money.”

Andy Curran, CEO Savings and Retirement, UK and Europe, Phoenix Group, said:

“The reality is the majority of people have to navigate the complexities of pensions on their own. SMF’s report identifies the cost of the huge Guidance Gap and how millions of savers could be substantially better off if this gap was closed. While regulated financial advice sets a ‘gold standard’ for helping people, it is not likely to be the solution for the vast majority. Even the Government’s free Pension Wise service is limited in its scope.”

“Across Phoenix Group we have around 3.5million customers aged between 50-64 making some crucial financial decisions without the level of guidance we believe they need. This does not sit comfortably with us.”

“Major initiatives over the past decade have encouraged pension savings – but saving more is than just one factor. We must now help people feel more comfortable in making financial decisions throughout their life to help them get better outcomes. It is time to close the Guidance Gap. “

“At Phoenix Group we are calling for a government-led Working Group to be set up to foster collaboration between the regulator, the advice community, providers and consumer groups to review the rules and address this challenge, so that millions more savers get to a better place, and a better retirement.”

SMF’s RECOMMENDATIONS

- Pension Wise needs to be expanded, with a broader scope and new digital tools. Policymakers should explore the case for expanding the scope of Pension Wise in two key ways. Firstly, providing tailored guidance on the level of pension savings likely to be needed to achieve a given retirement income. Secondly, allowing all of those over the age of 40 or 45 with a defined contribution pension to book a Pension Wise appointment, rather than just those over the age of 50, as at present. This would give individuals more time to correct for any inadequacies in their current retirement planning – for example by ramping up contributions into their pension pot or changing any non-pension investments.

- Pension Wise’s online offer needs to be improved, including through the provision of “robo guidance” and “robo modelling” that provides individuals with highly relevant information and a clear visualisation of the potential impact of different options on their financial position in retirement.

- At a minimum, the FCA should provide clearer information on its current definitions, including more concrete examples of what constitutes “guidance” and “advice”. This should include through provision of “gold standard” examples of guidance that is highly informative and actionable, without straying into advice territory.Ideally, the FCA should go further and adopt new definitions along the lines of those suggested by the Independent Review of Retirement Income. This would see two categories of information, guidance and advice: “personal recommendation” and “financial help”, with the latter replacing everything that is not full regulated fee-based advice where the adviser takes responsibility for a recommendation. Such an approach would give organisations more confidence to offer enhanced forms of guidance without falling foul of regulation.

- Using guidance or advice before accessing a pension should be made the default. Before accessing their pension pot, individuals should be requested by their pension provider to use some form of guidance and advice, and signpost individuals to a range of options, including online tools. As well as services offered by the pension provider, there should be signposting to Pension Wise and non-provider services, in order to build trust and give consumers choice. Individuals would have to explicitly say that they do not want support in order to access their pot without advice or guidance.

- The Government needs to invest significant resource into a nationwide pensions awareness campaign which brings home the need for individuals to prepare for retirement, makes them aware of the complexity of the decisions they face when accessing their pension pot and signposts them to support. It should be delivered through a partnership between government, industry and the third sector, ensuring common messaging.

NOTES:

- The report, A Guiding Hand, will be published on Wednesday 23rd February 2022 at 08:30 AM on smf.co.uk/publications/a-guiding-hand/. The report will be debated at an online event at 10am on Wednesday 23rd February here: https://www.smf.co.uk/events/preparing-for-the-golden-years-how-to-improve-pensions-advice-and-guidance-in-the-uk/

- This report was sponsored by Phoenix Group. The SMF retains full complete editorial independence.

- Polling: SMF/Opinium surveyed 2,011 UK adults aged 50-64 with a pension, between November-December 2021. Online focus grouping was also carried out, with 30 respondents aged 50-64 with a pension, between 17th and 21st December 2021.

- MODELLING SHORTFALLS IN SAVING – Methodology

“On average people aged 50-64 have pension savings that are 58% short of what they require, adding up to a total annual savings gap of £132bn across the country for those reaching retirement age”

1) 58% – this compares what people think they need to save in order to meet their desired retirement income, with what an independent online calculator suggests would actually be the case.

- What people say they need – is calculated from Opinium / SMF survey and is split by people’s stated desired retirement income.

- Stated desired retirement income is then inputted into online calculator (Pension Pot Calculator | Private Pension Growth Projection – Nutmeg) to determine a benchmark savings pot that might actually be required.

- 58% is the average difference between b and a.

2) £130bn under provision – multiplies the average under provision (2 above) and estimates of the number of people aged 65 with some personal pension wealth (using ONS data on population and Wealth and Assets Survey data on proportions with pension wealth).

Figure 11: Pension pot under-provision (as % of SMF estimated pension pot required) if individual expectations of required pots are met

Table 1: Pension under-provision by region

Contact

- For media inquiries please contact press@smf.co.uk – Report author Scott Corfe is available for interview about the project.

- For questions relating to Phoenix Group, please contact phoenix@teneo.com