Charging motorists a levy based on the miles they drive would be fairer and more popular than the current fuel duty regime and could even help address the cost of living crisis, new research presented in Parliament today shows.

In a report endorsed by Lord George Young, a former transport secretary, the Social Market Foundation said that a new road-pricing system is urgently needed to make transport policy more fair and fiscally sustainable.

The growth in electric vehicles – which do not incur fuel duty – will eventually leave the Treasury with a £30bn gap in tax revenue, equal to around 2p on the basic rate of income tax, the SMF said.

To avert that shortfall, ministers must have the “courage” to tell voters that a shift to road charging is “inevitable and sensible”, the SMF said.

The SMF report includes polling showing that more people support (38%) than oppose (26%) road pricing as an alternative to fuel duty. The poll was carried out by Opinium, with a sample size of 3,000.

The SMF also conducted focus group research which showed that voters regard fuel duty as more unfair than other taxes.

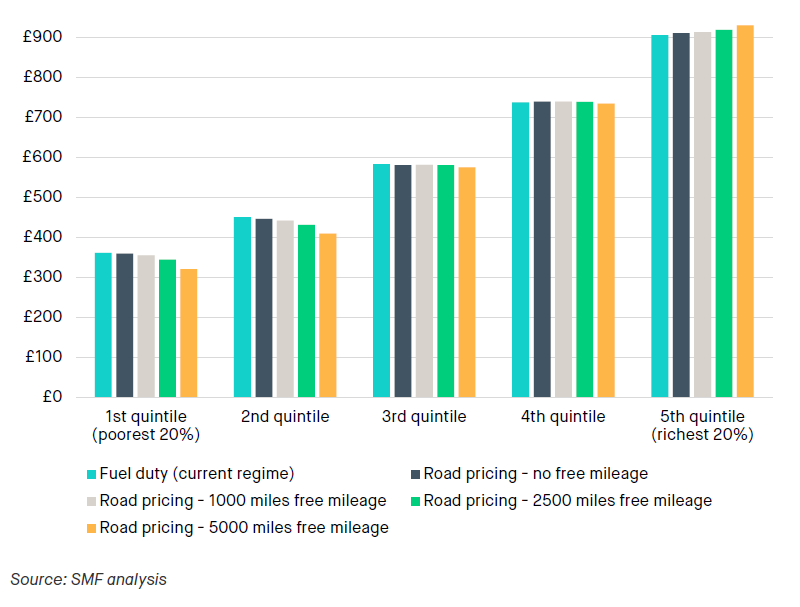

That view is supported by SMF analysis that shows fuel duty is regressive, falling more heavily on lower-income drivers. Even though such motorists drive fewer miles than richer ones, their fuel duty costs make up a greater share of their disposable income, the SMF calculated.

To fill the growing hole in the public finances and address unfairness in roads policy, the SMF said ministers should introduce a “simple” national road pricing regime with a fixed per mile charge. That scheme could be “revenue neutral” meaning it raises the same sums as fuel duty, but distributes the cost in a fairer way.

The report also makes the case for including a free “mileage allowance” akin to the tax allowance, meaning low-use drivers would not pay any charge and high-mileage drivers would make a contribution proportionate to their use of the roads.

A road-pricing regime with a flat rate for each mile driven and an annual “free” miles allowance for every driver would cut annual costs for almost half of all motorists, the SMF said. (See Notes)

Lord Young of Cookham will refer to the SMF report in the House of Lords on Monday during a debate on the economy in the Queen’s Speech.

Lord Young said:

“Successive administrations have looked at the case for road pricing and found it perfectly reasonable and sensible – then done nothing because they believe the public will not accept the change.

“This report challenges that assumption. It shows that, as so often, the public are more sensible and mature than political debate gives them credit for. When voters think about the challenges ahead for transport and tax, they accept that road pricing is a prudent and necessary step to take.

“The public are open to innovation because they know that the world has changed and will continue to change, so policy must change too.The welcome shift towards electric vehicles raises a clear question about the future of fuel duty levied on petrol and diesel. The unpopularity of that duty has grown steadily too. As this report shows, a well-designed system of road-pricing would be fairer and more popular than the status quo.”

Scott Corfe, SMF research director said:

“The current system of fuel duty is unfair, unpopular and unsustainable. A properly designed road-pricing regime will be fair, popular and good for the public finances and the environment. Voters know this, and privately so do the politicians. All that’s needed is the political courage to accept that road pricing is inevitable and sensible.

“The costs of driving are a factor in the cost-of-living crisis hitting many households, and fuel duty hits low-income people hardest. Road-pricing would be a progressive alternative, taking some of that burden away from those least able to pay it.”

The SMF report is entitled Miles Ahead. It was supported by a research grant from the European Climate Foundation.

The report comes as ministers prepare to respond to the House of Commons Transport Select Committee, which earlier this year said that the Government should start work on a road-pricing system “without delay”.

Recommendations from the SMF report:

- Government should work at pace to develop the infrastructure to support a simple national-level road pricing scheme, with a flat per mile rate and a free mileage allowance – and set out a timetable for implementing it. To reduce concerns about telematic devices in vehicles and enable swifter rollout, the infrastructure should include the ability to pay one’s road pricing bill using a mileage reading registered at the time of vehicle MOT, point of sale/scrappage of car and point of exiting the UK for foreign-registered vehicles.

- To reduce the burden on lower income motorists during the transition period from ICE vehicles to EVs, the government should either:

- Abolish fuel duty rates for petrol and diesel once road pricing is in place. ICE vehicle drivers would instead pay a road usage surcharge, set at a rate that is lower (in terms of per mile cost) than fuel duty.

OR

-

- Have a flat-rate national road pricing scheme, but reduce fuel duty rates to reduce the tax burden on ICE vehicle drivers.

- To improve transparency around motoring taxation and show clearly that road pricing is to be used to tackle congestion and other societal harms – rather than as a money-spinner for government – a Road Pricing Commission should be established. The Commission would provide annual recommendations for the setting of road pricing rates to meet social objectives such as reduced pollution and congestion.

- The Department for Transport should identify areas where motoring-related externalities such as congestion are notably higher than the national average. Central government funding should be made available to allow local authorities in these areas to roll out road pricing schemes such as congestion charges.

- The Department for Transport should identify areas where motoring-related externalities such as congestion are notably higher than the national average. Central government funding should be made available to allow local authorities in these areas to roll out road pricing schemes such as congestion charges

Notes

- Lord Young of Cookham was Transport Secretary 1996-97, and has also been Financial Secretary to the Treasury and Leader of the House of Commons. He is available for interview.

- The report, Miles Ahead, will be published at www.smf.co.uk/publications/miles-ahead-road-pricing/ at 7:00 AM on Monday, 16th May 2022. The report was supported by a research grant from the European Climate Foundation. The SMF retained full editorial independence.

- MODELLING THE DISTRUBUTIONAL IMPACT OF ROAD PRICING – SMF modelling shown in Chart 1 shows that a road pricing regime with a uniform per mile charge and a free mileage allowance per vehicle would be slightly financially beneficial to lower income motorists, compared with the current fuel duty regime. For example, a revenue-neutral regime with a free allowance of 2,500 miles would leave motorist households in the bottom two income quintiles about £20 per year better off than the current fuel duty regime. This amounting to about £92 million in aggregate. This rises to about £40 per year with a free allowance of 5,000 miles – £188 million in aggregate.

Chart 1: Mean fuel duty costs versus mean road pricing costs for a range of scenarios, vehicle-owning households. Per-mile road charge set at a rate that raises the same amount of revenue as fuel duty does at present. Free mileage is on a per vehicle basis.

Contact

- For enquiries, please contact press@smf.co.uk