It is all but announced that the Chancellor will continue to freeze fuel duty rates in the Spring Budget. But as the cost of the move to the Exchequer ticks up to nearly £130 billion - it's a shame that it will merely put money back into wealthy motorists' pockets, whilst also imperiling the Prime Minister’s goal of reducing debt as a proportion of GDP.

If you’re placing any bets on what Chancellor Jeremy Hunt will include in next week’s Spring Budget, one of your safest options is a freeze on fuel duty. Every budget since 2011 has frozen fuel duty rates at or below 2010 levels.

That includes last spring, when Hunt extended by a year what was originally meant to be a one year reduction in fuel duty, lowering the headline rate on petrol from £57.95 per litre to £52.95. With Hunt expected to maintain this supposedly temporary freeze for another five years, the accumulated losses are forecast to decrease government revenue by over £20 billion.

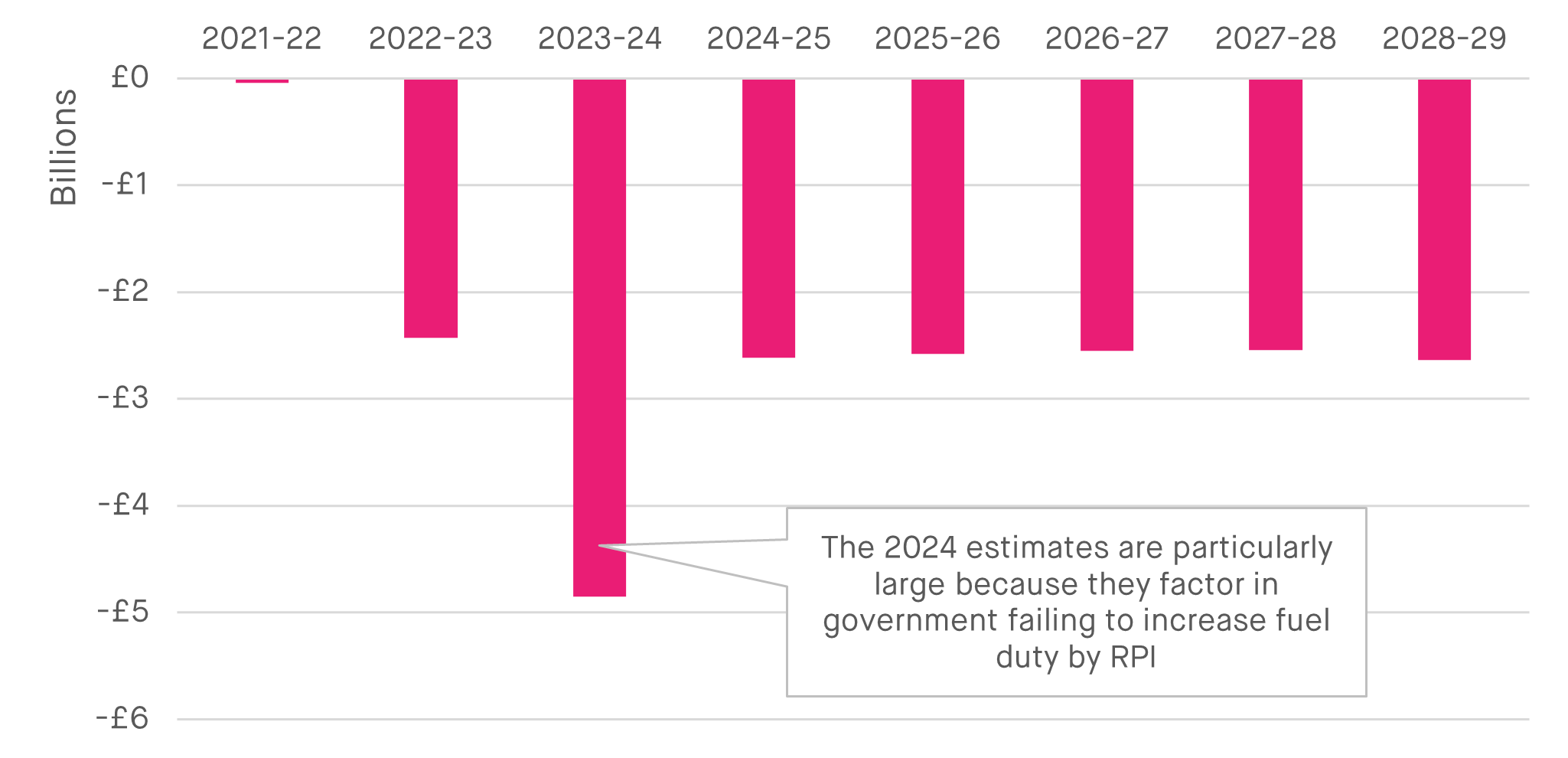

Figure 1: Annual losses resulting from the 5p cut reduction in fuel duty

Source: OBR and SMF analysis

Maintaining the fuel duty cut imperils the Prime Minister’s goal of reducing debt as a proportion of GDP. This is reckless, especially since last autumn’s statement met the debt to GDP requirement partly by assuming fuel duties would rise in the Spring. Maintaining fuel duty in this way will wipe out 43% of the government’s fiscal headroom by 2028-29, even further reducing the UK’s room for manouevre.

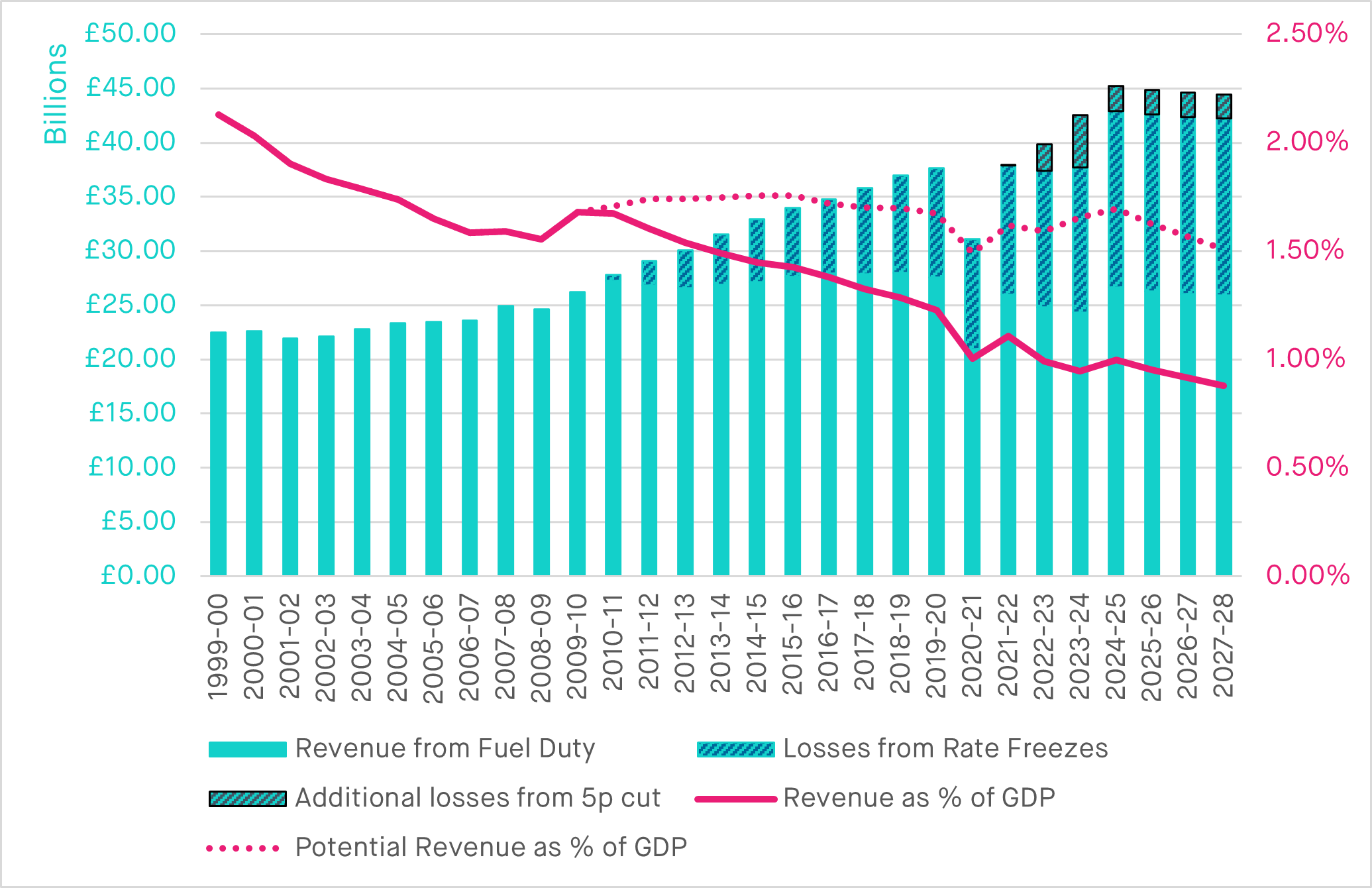

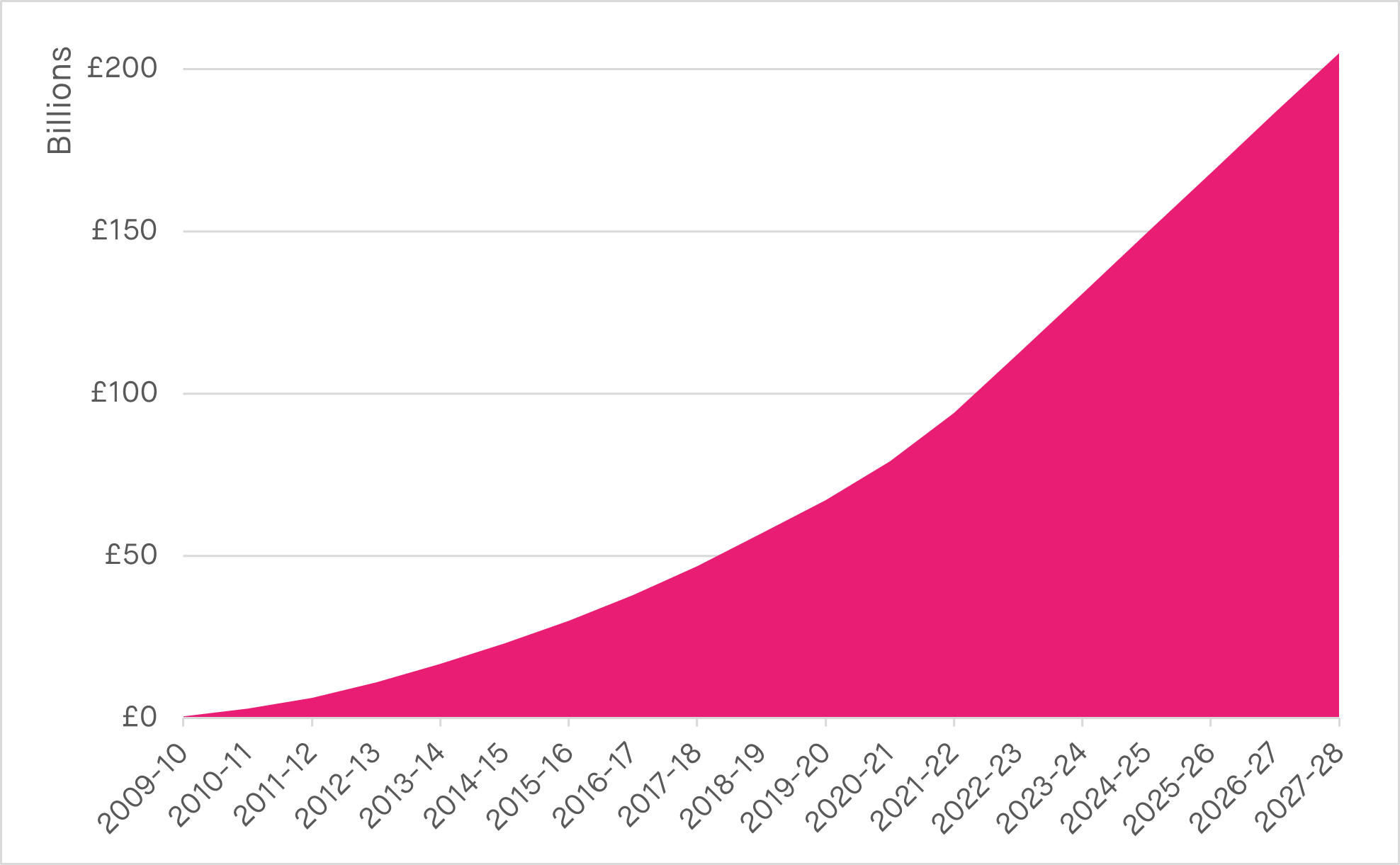

But that’s just the impact of one – admittedly very expensive – Budget, in 2022. Taking together the full impact of cuts and freezes to fuel duty since 2010, successive chancellors have spent almost £130 billion. By 2030, this number will tick past £200 billion. That’s enough to fund the entire NHS for a year. Meanwhile, the government has been unable to find the money to avoid local councils and public services being pushed to the brink.

Figure 2: Annual losses (billions) resulting from fuel duty freezes

Source: OBR and SMF analysis

Figure 3: Total losses from fuel duty cuts and freezes over time

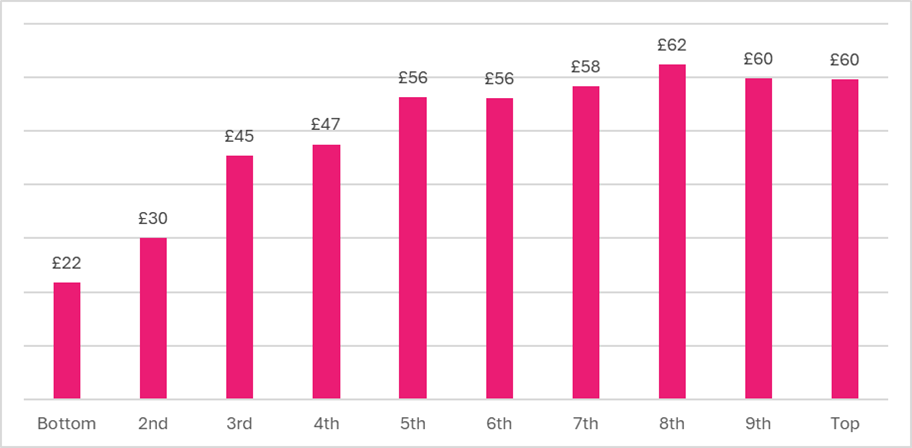

Such losses are particularly egregious due to the distribution of the benefit. Listening to the rhetoric around fuel duty freezes, and you would think that it provides urgently needed relief for lower income households and working class commuters. But in actual fact those households tend to drive less, own fewer cars, and travel more efficiently. In contrast, Britain’s wealthier drivers tend to drive less fuel efficient cars, with the “Chelsea Tractor” synonymous with inefficient SUVs. That means that if the Chancellor chooses to maintain the 2022 fuel duty cut, the richest households in the top income decile will pocket almost three times as much (£60) as the poorest in the bottom decile (£22).

Figure 4: Annual savings from the 5p rate freeze by decile

Source: OBR, ONS, and SMF analysis

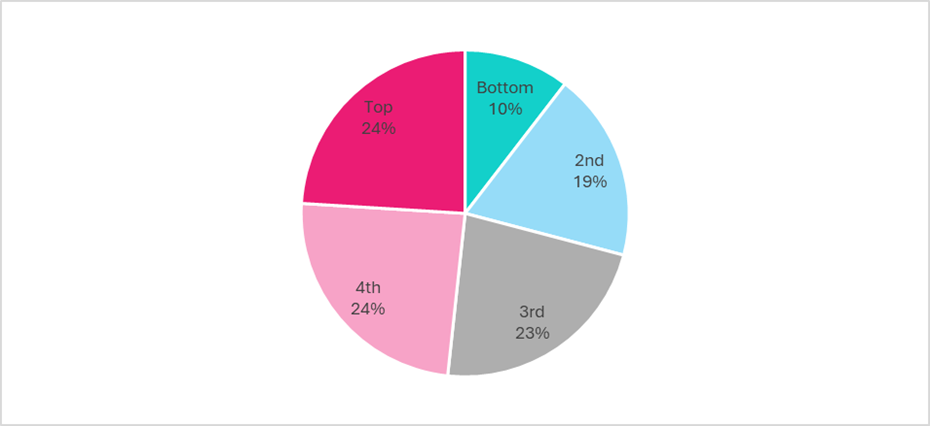

Of the £20 billion such a policy will cost the Exchequer, the bottom quintile receive just 10% of the benefits. Meanwhile the top will pocket 24%.

Figure 5: Distribution of savings from 5p rate freeze by quintile

Source: OBR, ONS, and SMF analysis

SMF analysis found that over five million people are being pushed into poverty by the cost of transport, and ways to lower these costs are desperately needed. So why don’t fuel duty freezes work? Despite its high profile, fuel duty is a minor element a driver’s total cost. In the year to 2020 (the last pre-pandemic year for which we have data) fuel duty made up just 17% of the median household’s weekly spend on motoring, limiting the effectiveness of any cuts. After £130 billion being spent over thirteen years of fuel duty freezes, the cumulative effects only save the median household £13 per month.

Yet this hasn’t stopped campaigners from arguing that the freeze has saved drivers “a small fortune” and is a necessary defense against the imaginary “war on the motorists”.

If Westminster wants to pull drivers out of poverty, there are ways it can help, but it will require turning on the spending taps rather than choking them off. Cheap alternatives like bus and rail can decrease congestion, improve health, and decrease household costs. SMF analysis last autumn found that for every 10% increase in public transport speeds relative to driving, the average household saves £435 per year. Other investments in electric vehicles could get Britain moving again while saving money and decarbonizing the sector.

The government is right to be concerned about the high cost of transport. But rather than indulge the misleading arguments that claim fuel duty freezes can lower them, government should invest in public transport and EVs which can make a material difference on the ground.