People from ethnic minorities are much less likely than white Britons to save into a pension scheme, putting millions at risk of financial hardship in later life, new research reveals today.

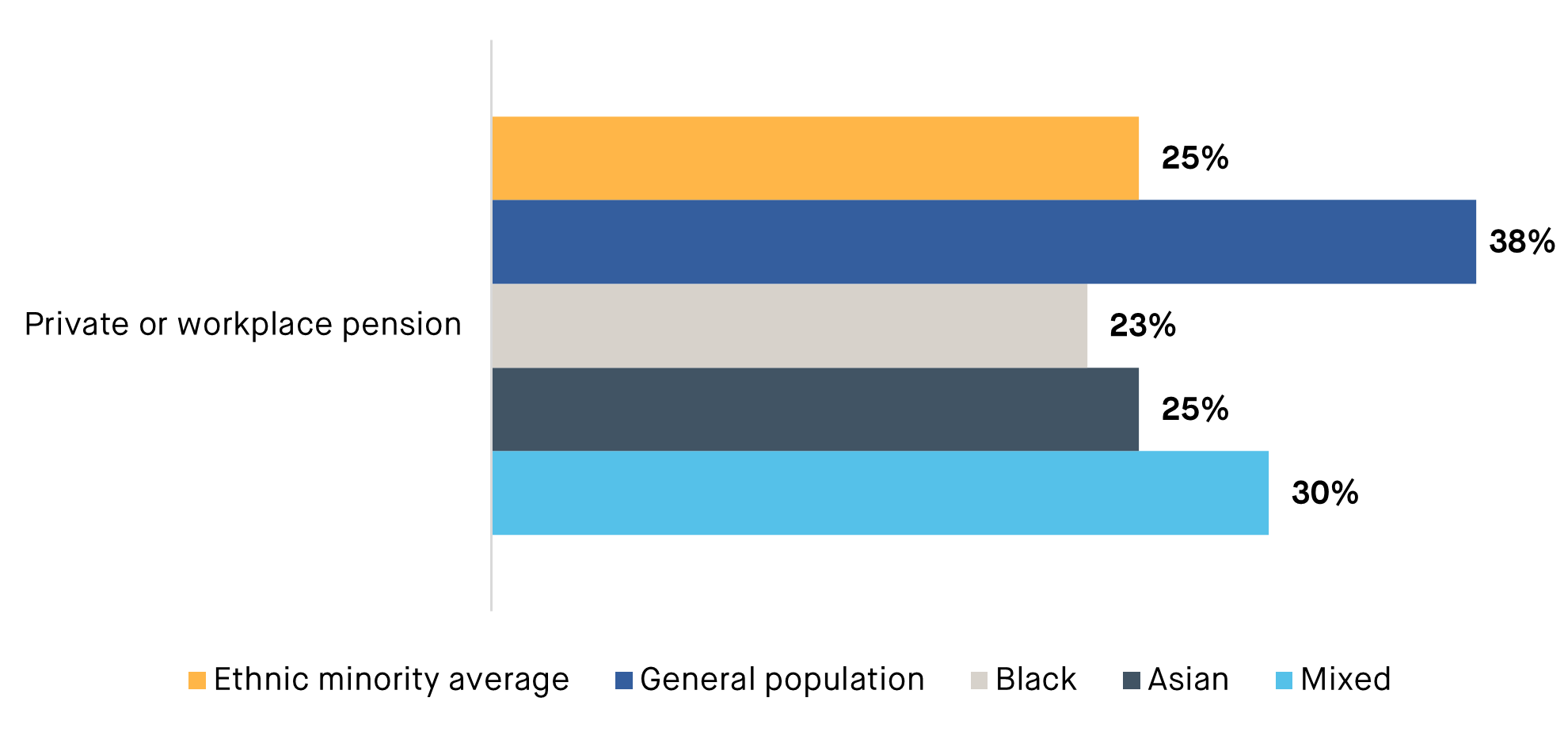

The Social Market Foundation think-tank found that just 25% of people from ethnic minorities have a workplace pension, well below the national rate of 38%.

In research supported by the consumer group Which?, the SMF found that ethnic minorities are more sceptical than others about the value of private pension savings.

At the same time, ethnic minorities are more likely than others to believe that the State pension will be enough to provide a decent retirement.

The SMF said this combination of scepticism about private pensions and faith in public provision may put many ethnic minorities in the UK at “greater risk of hardship in old age as the state pension and their savings may turn out to be insufficient for their needs.”

To address the problem, ministers should overhaul pensions auto-enrolment rules to bring more people – including many from ethnic minorities – into the workplace pension system, the SMF said. Because ethnic minority workers are more likely to be on low wages, they are often left out of workplace pensions.

The think-tank also challenged the financial services industry to do more to build ethnic minorities’ trust in pensions and savings products.

Based on a survey of ethnic minority in the UK, in-depth interviews with consumers and official data from the Financial Conduct Authority, the SMF research reveals significant disparities in the way ethnic minority and white people plan and save for the future:

- Only 25% of ethnic minorities had a private or workplace pension, compared to 38% of the general population. Among black people, only 23% have a pension.

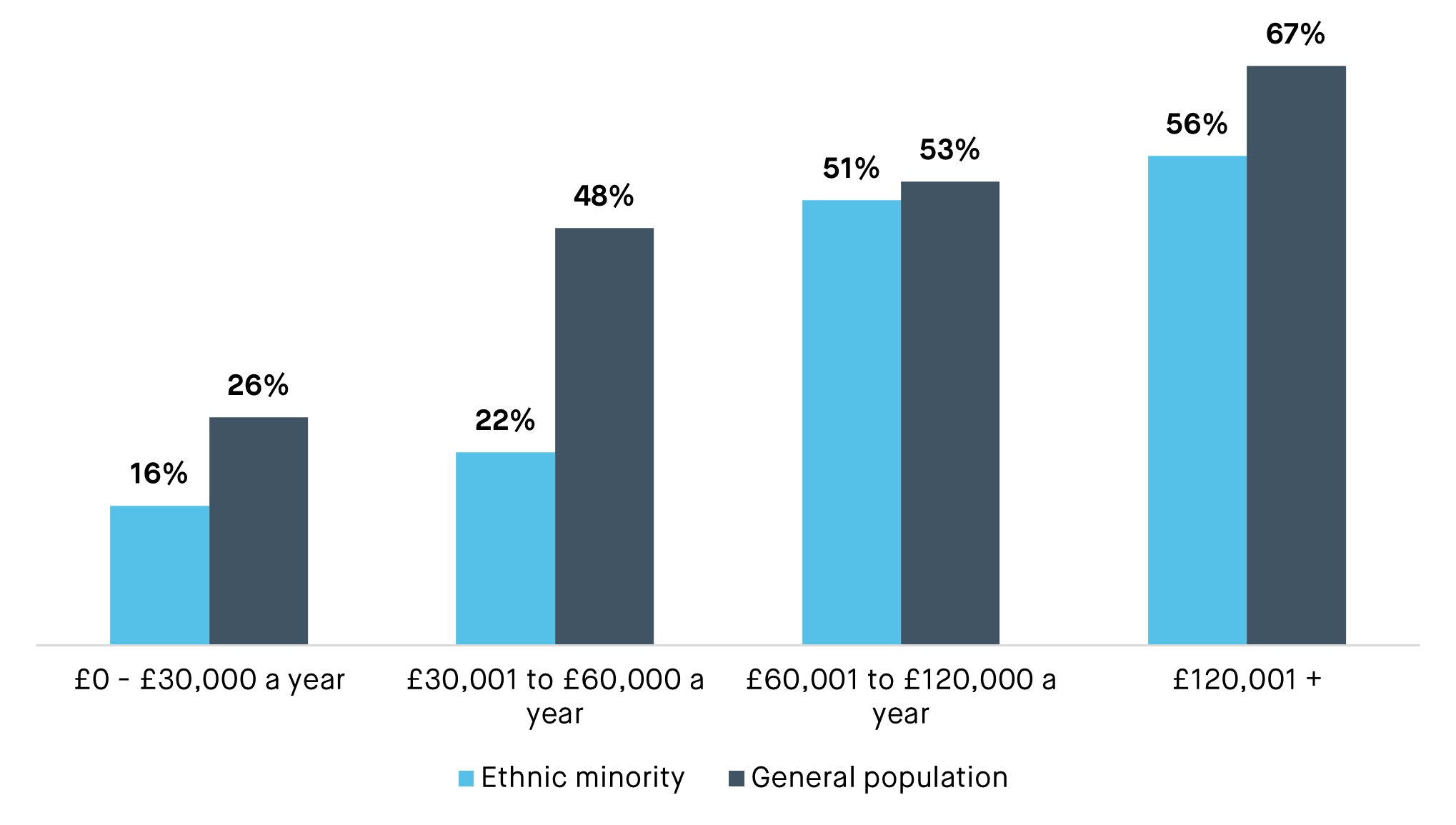

- 16% of ethnic minority consumers whose household earned under £30,000 a year contribute to a pension, compared to 26% of the general population.

- Among ethnic minority workers with household earnings between £30,000 and £60,000 a year, only 22% have private pensions, less than half the 48% rate for the whole population with similar earnings.

- Money isn’t the reason for the gap, as ethnic minorities are less likely to say their pension saving behaviour is driven by cash. While 25% of people that do not have a private pension say it is because they do not have enough money to spare, that figure is 20% for ethnic minorities

- 13% of ethnic minorities without a pension in our survey say they are not interested in having one, compared to 9% of the general population. Some consumers we spoke to expressed concerns over the value of pension schemes, both because they had doubts over whether they ever actually would retire and because they were uncertain over whether a pension is the best way to save for retirement.

- Despite the lower take up of pension and savings products, ethnic minorities are slightly more confident of how they plan to fund their retirement, with 63% describing themselves as being confident of having enough money to live on in retirement, compared to 56% of the White population.

- 16% of the ethnic minorities believe the state pension will be sufficient, compared to 12% of the general population. Similarly, while 14% of ethnic minorities think that their savings will be enough to cover their retirement costs, 10% of general population do.

Niamh O Regan, Researcher at Social Market Foundation, said:

“Longer lives and rising costs mean that building a solid private pension is a necessity for just about anyone who wants a comfortable retirement. Too many people from ethnic minorities are at risk of hardship in later life because they’re not saving into a pension and putting too much faith in the state pension.”

Recommendation: Change auto-enrolment rules

The said that the report was another reason for the Government to finally deliver a long-promised reduction in the age of eligibility for auto-enrolled pensions from 22 to 18.

Reform of auto-enrolment should also look at the earnings threshold for eligibility. Currently, automatic enrolment is triggered when an individual is earning over £10,000 a year. The SMF said that should be reviewed and lowered, possibly to zero. Australia recently removed its “minimum earnings limit” on workplace pension savings.

Aveek Bhattacharya, Research Director at Social Market Foundation, said:

“Sensible changes to pensions auto-enrolment rules would bring more ethnic minorities into pension saving, increasing their chances of enjoying the comfortable retirement that everyone deserves.”

Recommendation: financial services industry action

The financial services industry should do more to build awareness of and trust in its products among ethnic minority consumers, the SMF said:

“Our own survey for this report suggests that across pensions, savings and financial advice, as well as some insurance products, this may be a greater issue for ethnic minorities, who are more likely than the general population to cite lack of awareness as a reason for not taking out a particular financial product.

“Part of the responsibility for addressing this situation should lie with government, but it is also incumbent on financial firms to their bit as well.”

The SMF said that the Financial Conduct Authority’s new Consumer Duty – the principle requiring firms to act to deliver good outcomes for their customers – should act as a spur to do more to improve awareness and trust. The Duty imposes rules requiring firms to “enable and support retail customers to pursue their financial objectives”. The SMF said that: “Addressing the ethnic gap in understanding of and take-up of financial services should be part of discharging that obligation.”

Based on an estimate of 11 million ethnic minority people living in England, bringing the ethnic minority take-up of workplace pensions up to the level of the whole population would mean around 1.5 million people started saving into a pension. (See Note 1)

Gideon Salutin, Researcher at Social Market Foundation, said:

“Pensions and savings companies can discharge their duty to consumers and to wider society by doing more to demonstrate to Britain’s ethnic minorities the benefits of workplace pensions. This research should be a wake-up call to the pensions and savings industry to improve the way it talks to ethnic minorities in the UK. Many of them just don’t see the value in investing in conventional pension and savings products, putting some of them at risk of worse financial futures.”

Notes

- 25% of 11 million means 2.7 million people with pensions. If that rate matched the national rate of 38%, there would be 4.2 million ethnic minority pension savers.

- Ethnic minorities in the UK tend to be younger than the white population and younger people are less like than older ones to save, but the SMF also found that some ethnic minority consumers are more likely than others to report a lack of awareness and understanding of pensions and savings.

- Ethnic minorities in the UK also have higher levels of self-employment than others, putting them outside the range of current auto-enrolled pension saving. The SMF said that whatever the cause of the ethnic pension gap, policy changes that would address it are still needed.

- The SMF report, Squeezed out or opting out? will be published at https://www.smf.co.uk/publications/squeezed-out-or-opting-out/ on Monday 6th February, 2023.

- The report was sponsored by Which? Fund. The SMF retains complete editorial independence of its publications.

- Which? is a not-for-profit organisation wholly owned by the Consumers’ Association (registered charity no. 296072). The Which? Fund is funded by the Consumers’ Association, and supports research projects aiming to improve understanding of the consumer harms affecting diverse and disadvantaged communities, including in digital markets, and to develop evidence-based solutions to these issues. More information is available at: https://consumerinsight.which.co.uk/which-fund.

James Kirkup, Director of Social Market Foundation, said:

“Age and employment patterns are factors in pension take-up, but that’s not a reason for inaction. A better autoenrollment policy is worth doing, and would benefit at least some ethnic minorities in the UK .”

Figure 1: Pension uptake and ethnicity

Source: SMF Opinium Survey July 2022

Figure 2: Private pension uptake by income band and whether they are an ethnic minority

Source: SMF Analysis of Financial Lives Survey 2021

Research methods: SMF/Opinium surveyed nationally-representative sample of 1,000 people, as well as a booster sample of 500 respondents all from ethnic minority backgrounds. Survey work was done in July 2022. The ethnicity breakdown of the booster survey included 65% Asian respondents, 28% Black respondents, 13% respondents of a mixed ethnicity, and 2% respondents of an Arab or any Other ethnicity.

To build a deeper and richer picture of ethnic minorities, we conducted 21 in-depth online qualitative interviews with ethnic minority consumers. This sample included 11 people of Asian ethnicity, 7 people of Black ethnicity, 2 people of a mixed ethnicity and 1 person of an Arab or Other ethnicity.