Cutting fuel duty does little to help “strugglers and strivers” while mostly benefiting people on the highest incomes, a think-tank shows today.

Someone earning around £29,000 a year will get only half the benefit of a Budget fuel duty cut as someone on £86,000, the Social Market Foundation said, adding that many of the poorest will get no benefit at all from a tax cut that will cost the Treasury billions.

The Social Market Foundation is releasing an analysis of fuel duty and household incomes as the Chancellor prepare to deliver a Budget widely expected to cut fuel duty in real terms.

The SMF, a cross-party think-tank, said that because richer people are most likely to drive, and to drive more miles, most of the tax savings from a cut in fuel duty goes to the best-off. And since almost half of the poorest households in the UK don’t own a car, they get no benefit from a measure that costs the Exchequer billions of pounds.

Since 2010, repeated cuts and freezes in fuel duty have seen the Treasury give up more than £66 billion. The SMF calculated that the poorest fifth of households have seen just £8 billion of savings from that, while the richest fifth have gained more than twice as much, £17 billion.

Looking ahead to this week’s Budget, the SMF said that the fuel duty freeze that many commentators are expecting will be worth almost three times as much to people on high incomes as it is to the poorest.

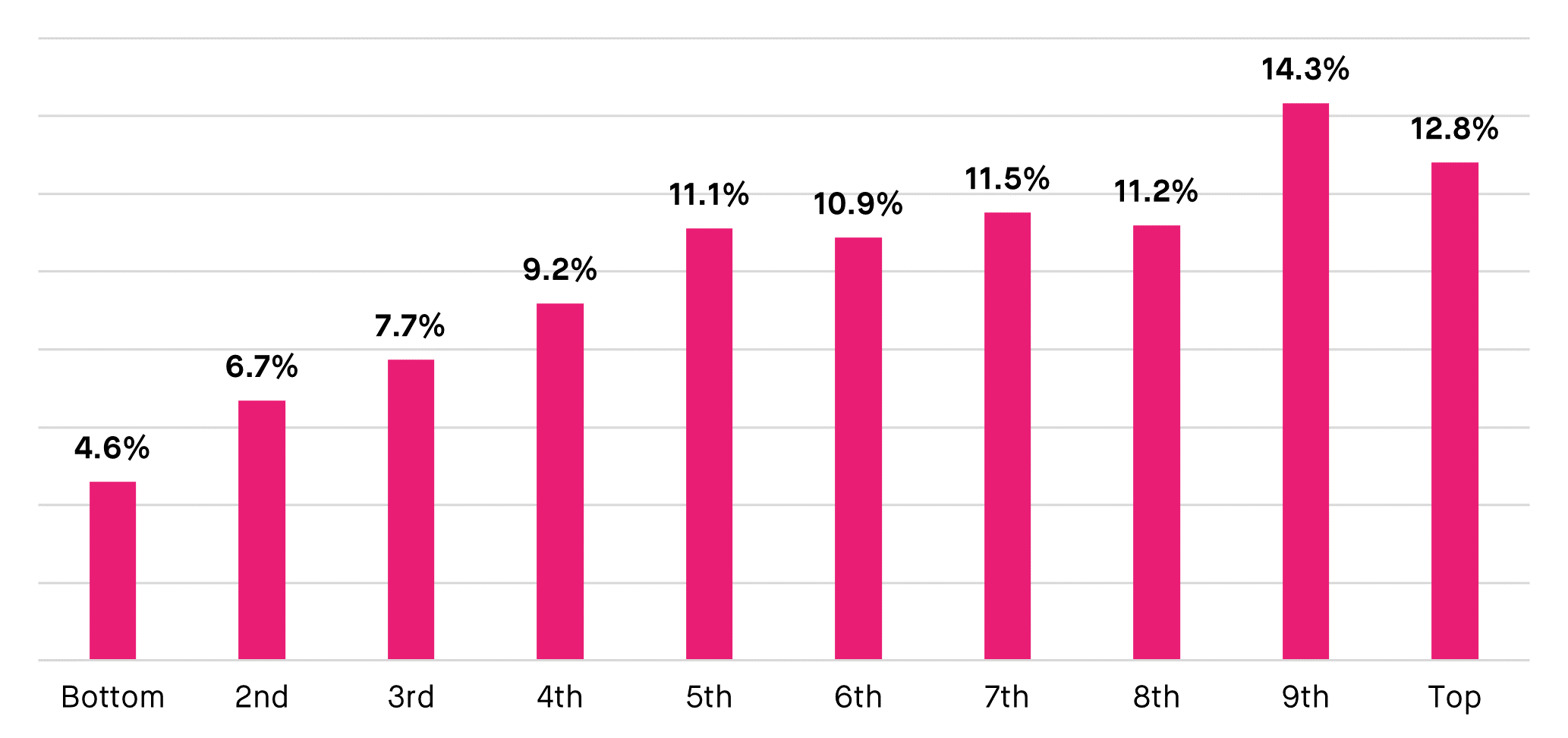

People in the bottom income decile would receive just 4.6% of savings from the expected fuel duty freeze while 12.8% of the giveaway will go to the top tenth of earners.

The typical household in the bottom income decile has a gross income of around £15,000. For the top decile, typical incomes are £185,000.

The SMF calculations also show that someone in the third income decile – where incomes are typically around £29,000 – will get only half as much of the benefit from fuel duty cuts as someone in the ninth decile, where incomes are around £86,000 (See Note 1).

Jeremy Hunt is thought to be considering yet another cut to fuel duty revenues by including provisions to make permanent last year’s Sunak’s “temporary” 5p cut, then freezing duty for at least five years.

Last year’s cut cost the exchequer £2.4 billion. Of this just £109 million (4.6%) is estimated to have reached the poorest decile. Making the cut permanent would cost the exchequer £27 billion over five years in unfunded tax cuts. Of that lost revenue, £8.5 billion (27.1%) would likely go to the richest 20%.

Gideon Salutin, SMF researcher, said that all politicians should be more honest with the public about fuel duty, tax and transport::

“In the popular imagination, petrol and diesel taxes are a heavy burden on struggling families. In reality, 38% of the poorest fifth of households in the UK do not even own a car, while it is the richest that are more likely to have gas-guzzling SUVs and second (or even third) vehicles.

“Instead of indulging in a shallow and misleading approach to fuel duty, both major parties should take the opportunity of next month’s budget to have a mature debate about the costs of subsidising car use, and the impact that has on both the environment and social inequality.”

James Kirkup, director of the Social Market Foundation, said:

“Fuel duty cuts are a bad way to help strugglers and strivers – they’re really a giveaway to the rich.”

“Fuel duty is misunderstood, so cuts in fuel duty are routinely mis-sold. Many of those who support such cuts say they are justified because they give financial help to strugglers and strivers, people who can barely make ends meet. In fact, fuel duty is mostly paid by the better off, meaning cutting that duty is little more than a tax cut for the rich, often funded by cutting services that are used by the poor.”

“Those who want fuel duty cuts to support people who are financially struggling are often acting in good faith, seeking changes they think will offer that help. But despite those honourable intentions, fuel duty cuts are in reality a really bad way to get help to White Van Man and Woman and other hard-working Brits.”

Notes

- Figure: Share of savings from potential fuel duty freeze by decile

Source: ONS

- The SMF analysis of fuel duty is published at https://www.smf.co.uk/commentary_podcasts/fuel-duty-cut-giveaway-to-rich/.

- Typical gross incomes for each decile are from 2021 – https://www.ons.gov.uk/peoplepopulationandcommunity/personalandhouseholdfinances/incomeandwealth/datasets/theeffectsoftaxesandbenefitsonhouseholdincomefinancialyearending2014

Contact

- For media enquiries, please contact press@smf.co.uk

ENDS