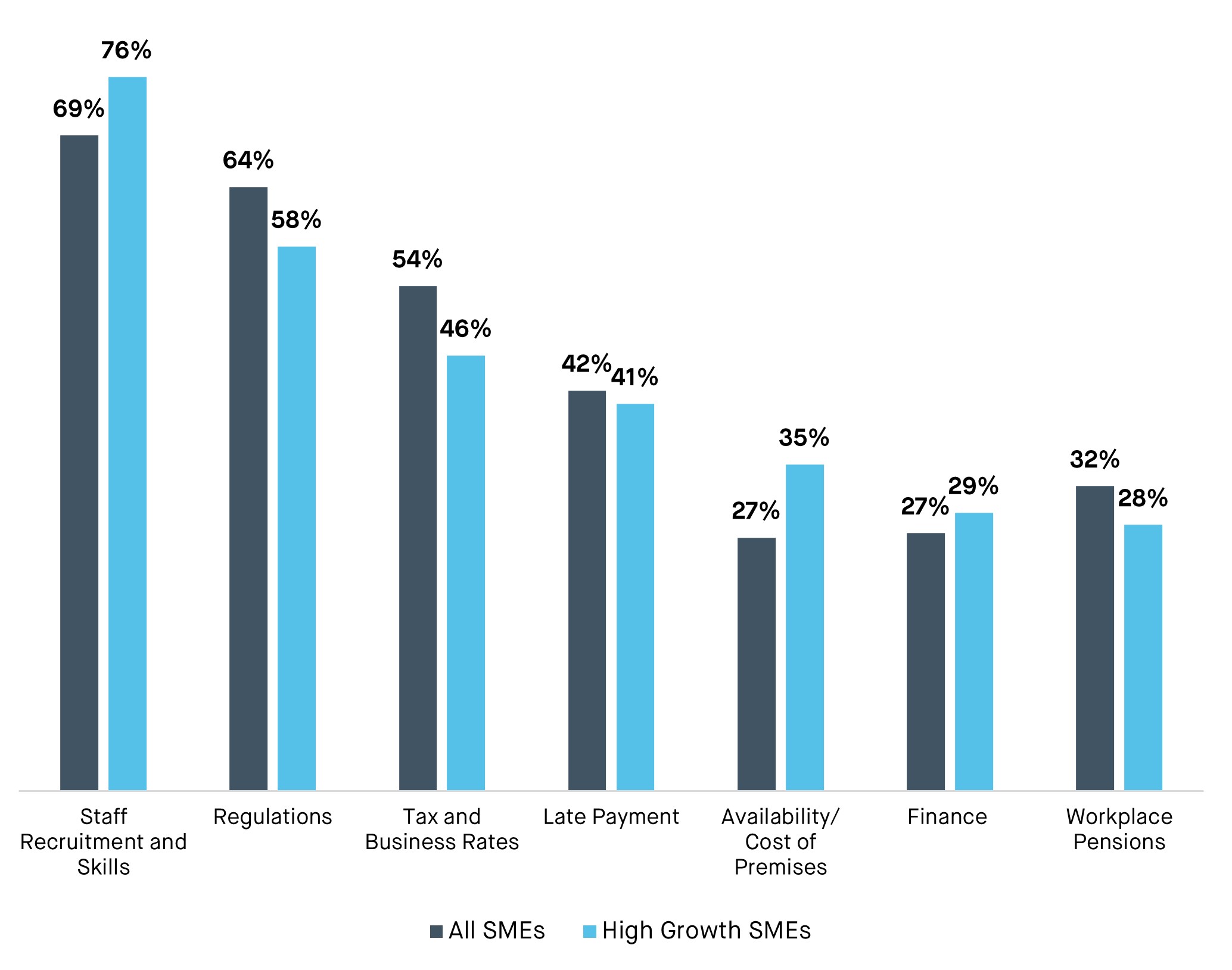

Nearly 7 in 10 (69%) SMEs say that recruiting and developing adequately skilled staff is their biggest barrier to growth, a think tank reveals today.

The Social Market Foundation – a cross-party think tank – has warned that a lack of focus on the skills crisis is limiting the UK from being a place for not just start-ups, but also scale-ups, where businesses are able to grow to their full potential. In a new report from the SMF, sponsored by OakNorth Bank, analysis of a survey of SMEs over time found that staff and skills was the leading barrier to success for 69%, rising to 76% among ‘high-growth’ SMEs (See notes).

The SMF says that the current political focus on access to finance is unlikely to bring substantial rewards unless it is combined with a more strategic and joined-up approach to supporting business growth. In particular, it calls for the establishment of a cross-governmental scale-ups unit, with the mission of creating £50 billion of value (measured by the market capitalisation of scale-ups) by 2028.

It also recommends that scale up policy should aim to foster economically productive ‘hubs’ – key sectors in particular parts of the country, where the UK has a reasonable chance of developing world beating firms. For example, this might involve greater focus on climate and green science, financial technology, therapeutic care services and creative industries.

Recent months have seen intensifying focus on the finance system as a route to growth. The Chancellor’s Mansion House speech in July 2023 focused on boosting the supply of investment capital available to support the growth of high potential businesses. The Shadow Chancellor has also signalled the Labour Party’s intent to push pension funds to pump cash into UK start-ups and high-growth firms.

Even prior to these plans, there have been a series of reviews and policy changes – like the creation of the British Business Bank – attempting to make it easier for SMEs to grow over the last decade.

The SMF argues that there is mounting evidence that the government needs to broaden this approach. From 2016 to 2021, ‘staff recruitment and skills’ was the most frequently reported obstacle impeding the success of ‘high growth’ companies, cited as a problem by three-quarters of such firms, according to SMF analysis. (See notes) Planning regulations that make it harder to house workers and establish firms’ premises are another obstacle.

These findings should not be taken to mean that there is no issue in accessing finance, rather that more targeted interventions are required, the SMF emphasised. Regional inequalities in equity funding, and overall weak investment from institutional investors in SMEs are a few issues that require targeted intervention.

John Asthana Gibson, a Researcher at the SMF, and lead author of the report, said:

“There are growing concerns that the UK has lost its competitive edge as a thriving business environment, and this is demonstrated by our inability to grow and scale the many high potential businesses that have started here.”

“But focusing on capital as the solution above all else has been the wrong approach. It’s high time that we listen to scaling businesses, who are clearly telling us that the greatest obstacle to growth is the difficulties obtaining talented workers.”

Rishi Khosla, co-founder and CEO of OakNorth, continued:

“OakNorth sponsored this report because we know first-hand the disproportionally positive impact that successful growing businesses have in the UK – the c.£10bn that OakNorth has lent to date has directly contributed to the creation of more than 40,000 new jobs and 29,000 new homes. We also know from our customers that so many innovative businesses across the UK still face multiple barriers holding back their growth. We’ve had many reviews and much commentary over recent years, but those barriers remain. As this report has shown, access to capital is just one challenge and not even the primary concern. It’s time for fresh thinking and practical measures, and the Social Market Foundation has not disappointed in providing these. It will take political will, clear strategy, and a concerted, well-resourced effort, but if the Government of the day takes the challenge on, we will all benefit.

Notes

- The SMF report, Full scale, can be viewed and downloaded here https://www.smf.co.uk/publications/full-scale-british-businesses

- The report is sponsored by OakNorth Bank. The SMF retains full editorial independence.

Figure: Percentage of firms reporting issues as barrier to their business success by firm type

Source: Longitudinal Small Business Survey, SMF Analysis.

- The full list of SMF’s recommendations. The Government should:

-

- Establish a cross-governmental Scale-ups Unit, with the mission of creating an £50bn in public market cap value from UK growth startups over the next 5 years by 2028. The unit should be led by the Department for Business & Trade and should facilitate promising businesses to access support and remove frictions, coordinate and evaluate government policies and schemes and direct public money to the most effective interventions – across immigration, health, treasury funding, industry, workplace and pensions, research funding, tax incentives, regulation.

- Identify key sectors to prioritise for the UK, such as green/climate science, fintech, life sciences, data science/AI, therapeutic care services, hospitality/tourism, creative/performing arts. For each of these sectors:

-

-

- Identify a geographic hub for the sector, playing to current strengths while also ensuring that hubs are spread across the country.

- Attract the best global talent in each of these sectors to these hubs, and facilitate visas for that talent.

-

-

-

- Invest in the UK’s skill base in each hub around the specific sector – scaling up the local universities in each hub, including for adult education, tripling research spending – to create talent density around each sector in each hub.

- Target financial interventions to support firms in promising clusters – potentially using EIS/SEIS/R&D credit budgets and focusing on equity investment through the British Business Bank.

- Reform planning to boost business and homes in each hub.

-

-

- Create a more supportive environment and business culture for scale-ups, with a particular focus on reducing bureaucracy and making public and private sector procurement more favourable.

- Increase funding for schemes like Be the Business to enhance their capacity to provide training and mentoring for leaders of growing companies.

- Remove barriers to university spin outs – by standardising agreements with universities – e.g. 5% university ownership for professor-led spin-outs and 0% for students – IP kept by start-up companies – and rely on philanthropy.

- Help promote increased ambition in the UK, by showcasing success stories, and celebrating and mentoring entrepreneurship at schools, colleges and universities.

About OakNorth Bank plc

Launched in September 2015 and founded by entrepreneurs, OakNorth Bank provides fast, flexible, and accessible debt finance to the UK’s Missing Middle.

Since its launch, the bank has:

- Lent c.£10b, directly helping with the creation of 40,000 new jobs and 29,000 new homes across the UK.

- Raised deposits from c.200,000 savers.

- Supported several hundred businesses across the UK with the debt finance to pursue their growth ambitions.

It is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

Visit www.oaknorth.co.uk for more information.

Contact

- For SMF media enquiries, please contact press@smf.co.uk

- For OakNorth media enquiries, please contact press@oaknorth.co.uk