‘Housing sin taxes’ – levied on vacant homes, ‘house flipping’ and foreign buyers – could be a useful source of revenue, a think tank argues today.

In a report out today, funded by the Nuffield Foundation, the Social Market Foundation finds that other English-speaking countries make far greater use of such taxes than the UK. Canada, Australia and New Zealand levy greater charges on foreign buyers and empty properties than the UK, and unlike the UK also tax houses sold soon after purchase.

Whilst these housing excise taxes have generally failed to deliver their original objective – increasing housing supply (see notes) – the SMF finds that they have been effective at raising money. The revenue could be spent providing, for example, council tax rebates to private sector renters to help them save for a deposit, thus improving their chances of getting on the housing ladder, the SMF said.

The report is the latest in a series comparing housing policy across English-speaking countries (which includes Ireland, Canada, Australia and New Zealand and the UK). The SMF found that the UK has the lowest rate of homeownership in that group, and saving for a deposit is the greatest barrier to getting on the property ladder. Britons also have the highest housing costs in the Anglosphere, accounting for over a quarter of disposable income, the SMF found.

At present, the UK government applies a 2% surcharge on home purchases in England and Northern Ireland by individuals that do not have citizenship or residency. This is modest, compared to Australia, where combined excise taxes on non-residents approach 15% in some states, or Canada, where they can reach 25%. The Labour party had said in spring last year that it was considering a higher surcharge on foreign buyers. Based on current transactions, a 25% tax on foreign buyers’ purchases could raise £855 million each year.

There are an estimated 1.5 million vacant dwellings in the UK at present. Depending on design of the levy, taxing these properties as little as 1% of their value could provide billions in revenue for the Treasury. Both Australia and Canada tax their respective vacant homes as much as 3% depending on their location.

Australia and Canada also fully tax gains made from the sale of a property if it is sold within a year of the purchase, essentially denying sellers the benefit of capital gains tax exemptions. This tax is meant to discourage ‘house flipping’, and if the UK implements it – it would apply to 2.3% of home sales. At current levels, a 50% tax on the profits from house flipping in the UK would raise £550 million per year.

Other recommendations from the report to increase access to homeownership include:

- Provide council tax rebates to private sector renters to help them save for deposits.

- Offer insurance for high loan-to-value mortgages. In Canada, insurance products are applied to mortgages where the deposit is under 20%, which the SMF argues encourages banks to lend to more low deposit customers and has contributed to a more stable and equitable Canadian market.

- Require banks to give mortgage applicants information on 10, 15, or 30 year fixed rate deals – longer term fixed rate mortgages are commonplace elsewhere, but not in the UK, and seem to have produced more stable and accessible markets.

- Reform council tax to make it more progressive, and base it on property values, re-evaluated every three years. Richer households currently pay proportionately less in council tax, and in England and Scotland the rate is based on a property’s value in 1991. No other country in the Anglosphere relies on valuations from more than six years ago.

- Abolish stamp duty to allow homeowners to downsize and make up the revenue by decreasing capital gains tax exemptions for secondary properties. Though lucrative, stamp duty is paid by the wrong party in housing transactions and prevents efficient movement in the property market.

In subsequent papers, the SMF will explore additional areas of housing policy across English-speaking countries – planning reform, alternative ownership models, and renter support policies – to examine if successes from abroad can be replicated, and how failures may be avoided.

Gideon Salutin, Senior Researcher at Social Market Foundation, said:

“One and a half million homes are left vacant in the UK, while two hundred thousand are owned by individuals who are not residents in the country. At a time when the country is desperate for homes and the government desperate for money, we should be using these as sources of revenue, rather than letting them sit idle. The billions in revenue these taxes could generate should be used to help those losing out in the housing market.”

Notes

- The SMF report, Home economics, will be published at https://www.smf.co.uk/publications/increasing-access-to-homeownership/ on Tuesday 19th March, 5 PM.

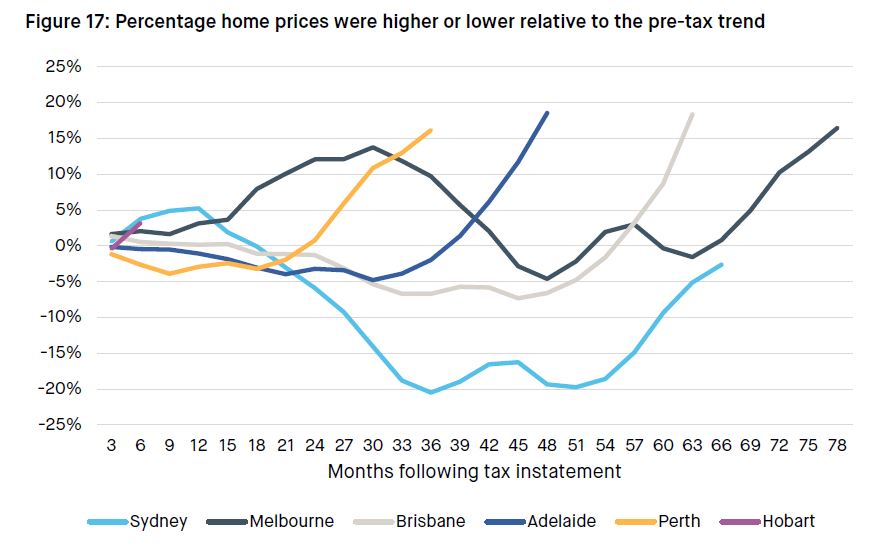

Source: ABS and SMF analysis

- The first paper of the series, can be found at: https://www.smf.co.uk/publications/dwelling-on-it-housing-crises/

- The Nuffield Foundation is an independent charitable trust with a mission to advance social well-being. It funds research that informs social policy, primarily in Education, Welfare, and Justice. The Nuffield Foundation is the founder and co-funder of the Nuffield Council on Bioethics, the Ada Lovelace Institute and the Nuffield Family Justice Observatory. The Foundation has funded this project, but the views expressed are those of the authors and not necessarily the Foundation. Website: nuffieldfoundation.org Twitter: @NuffieldFound

Contact

- For media enquiries, please contact press@smf.co.uk

ENDS