Only 1% of UK’s SMEs are ‘scale-ups’, generating nearly £500bn a year, new research shows today. With 1 in 6 of them being in health and social work, and IT also dominating, it highlights the strengths and potential of the UK economy.

New research published today by the Social Market Foundation think tank, and sponsored by OakNorth, utilises restricted access data from the Office for National Statistics to identify the fastest growing small and medium-sized firms, and their characteristics.

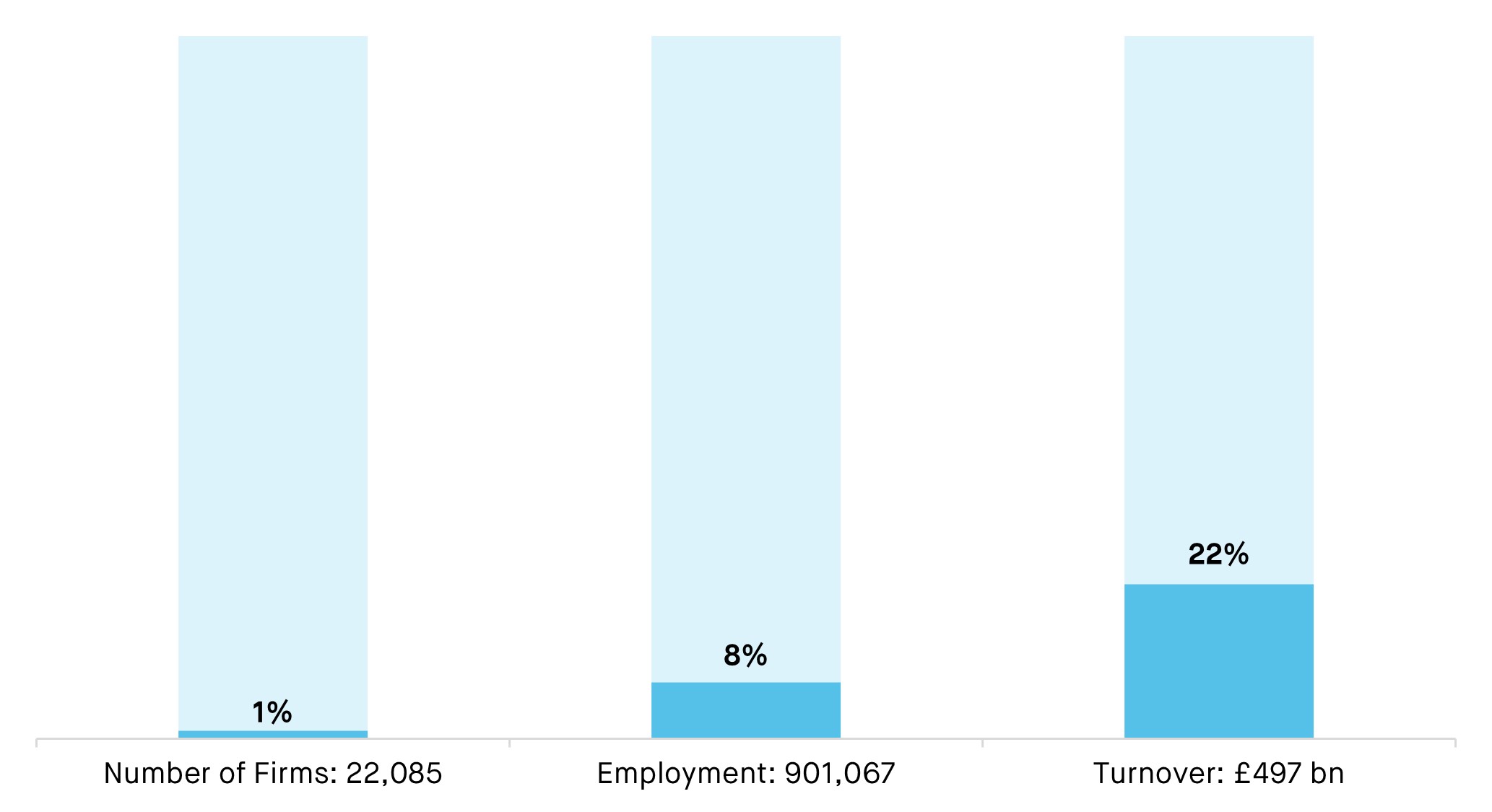

It highlights the contribution scale-ups – firms with high-growth potential – make to the economy. Scale-ups (defined in the research as small and medium sized enterprises growing at 20% on average each year between 2018 and 2021) are 1% of all UK SMEs, but account for over a fifth (22%) of all SME turnover, amounting to £497bn.

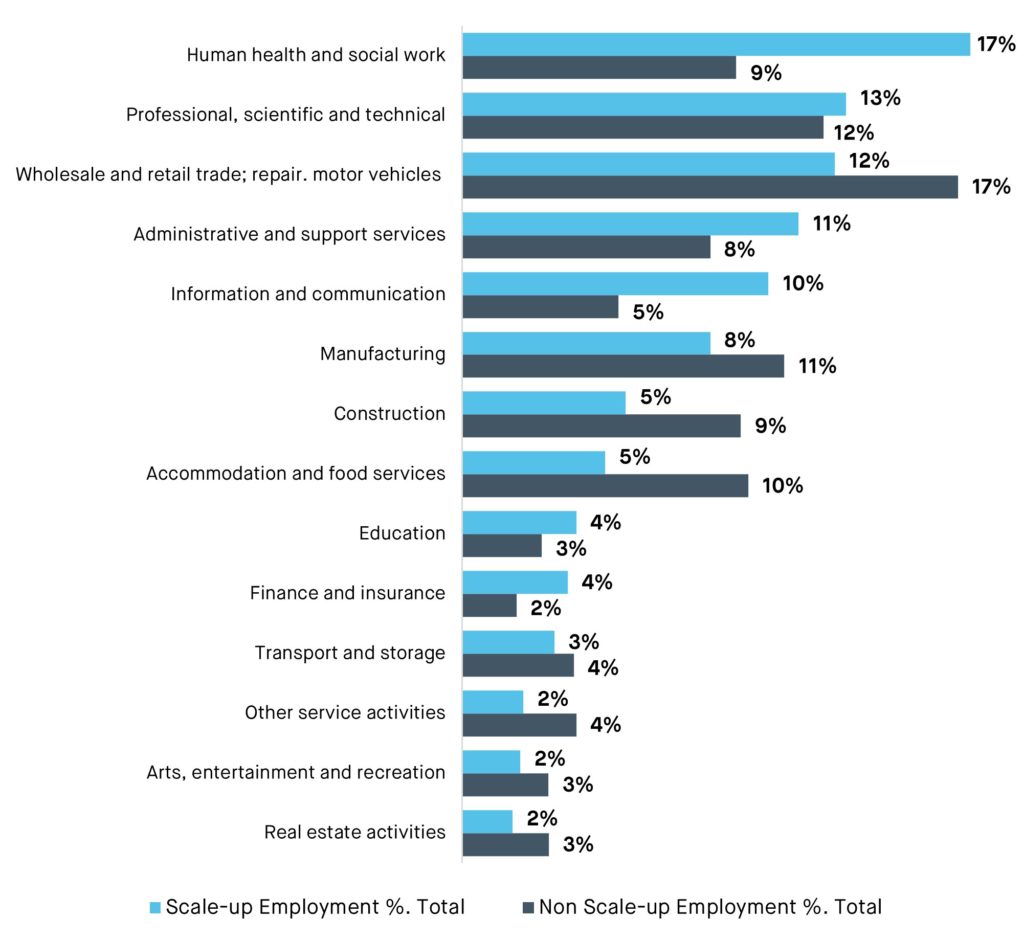

The analysis shows that scale-ups are concentrated in a few broad sectors such as health and social work, IT, and wholesale and retail trade (see notes). Nearly a fifth (17%) of the UK’s scale-up employees are employed in health and social work, whilst about 7% of them are employed across the creative sector, real estate and transport and storage, all put together. To grow the number of scale-ups in key sectors, such as in real estate activities – which accounts for just 2% of scale-up employment – the research recommends reform planning to boost business expansion and home building.

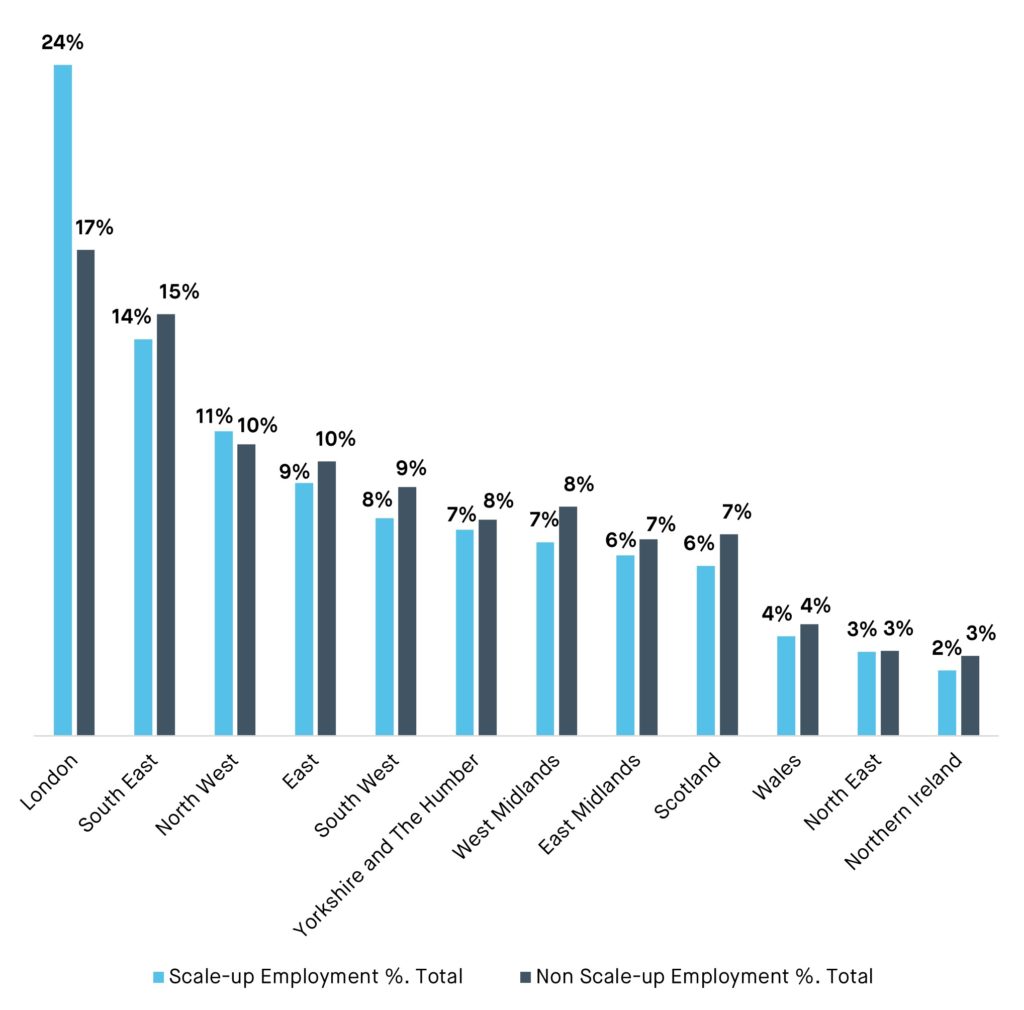

On average, each scale-up employs over seven times as many workers as their non-scale-up SME equivalents. However, scale-ups are not spread evenly across the country – while 38% of scale-up employees work in the capital and the South East, and 20% are located across the North of England, only 12% are across Scotland, Northern Ireland and Wales combined (see notes).

The analysis highlights the need for the Government to identify key sectors to prioritise for scale-up growth and seek to develop geographical hubs for each sector. These hubs should receive concerted policy attention – such as assistance with visas to attract the best global talent to the hubs, and investment in local skills, infrastructure and research spending.

Such a holistic approach is needed to move beyond the singular focus on particular issues (especially access to finance), that have left other key barriers to growth – regulations, planning restrictions on development, and a less entrepreneurial culture – untouched, the analysis argues.

John Asthana Gibson, Researcher at Social Market Foundation, said:

“Our inability to scale the many high potential businesses that have started here, and ensure that they are found across sectors and spread throughout the country, is holding the entire economy back. But there is no silver bullet to the situation. Both the UK’s business infrastructure and culture needs to change in order to unlock scale-up growth.”

The analysis is intended to accompany the SMF and OakNorth’s Full Scale report, published in September this year, which identified the barriers to scale-up growth in and across the UK, and developed a policy agenda to address the issue (see notes).

Rishi Khosla, co-founder and CEO of OakNorth Bank, said:

“We know the outsized contribution scale-ups have on the UK economy which is why we have made it our mission to support and empower these businesses. Since our launch in September 2015, we have lent over £10b to scale-ups, directly supporting the creation of more than 40,000 new jobs and 29,000 new homes across the UK – the majority of which are affordable and social housing. Yet despite their significant contribution to the economy, SMEs still face significant barriers to scaling. Addressing these barriers is vital for ensuring the UK maintains its pole position across sectors such as fintech, life sciences, and social care, as well as boosting productivity and economic growth.”

ENDS

Notes

- The SMF briefing, The scale of the opportunity, will be published at https://www.smf.co.uk/publications/the-scale-of-the-opportunity/ on Wednesday 8th November 2023.

- The SMF’s first paper on the topic of scale-ups, Full Scale, is published at https://www.smf.co.uk/publications/full-scale-british-businesses/

- Both reports are sponsored by OakNorth Bank. The SMF retains full editorial independence.

- Data and research methodology: The research employs business demography data from the Office for National Statistics. With this data, we looked at high growth SMEs, establishing what proportion of firms, turnover and employment these high-growth firms account for relative to the whole population of SMEs.

Figure 1: Scale-up employment and turnover as a percentage of all SMEs

Source: SMF analysis

Figure 2: Scale up and non-scale-up employment by region, as a percentage of national SME employment

Source: SMF analysis

Figure 3: Scale-up and non-scale-up employment by sector, as a percentage of national SME employment

Source: SMF analysis

The full set of recommendations:

- Establish a cross-governmental Scale-ups Unit, with the mission of creating an £50bn in public market cap value from UK growth startups over the next five years by 2028. The unit should be led by the Department for Business and Trade and should facilitate promising businesses to access support and remove frictions, coordinate and evaluate government policies and schemes and direct public money to the most effective interventions – across immigration, health, treasury funding, industry, workplace and pensions, research funding, tax incentives, regulation. However, effective policies that encourage scale-up growth need quality data on the activities of companies in the economy. As such, this scale-up unit should also have the responsibility to improve the quality and accessibility of data on, and the monitoring of, scale-up companies.

- Identify key sectors to prioritise for the UK, such as green/climate science, fintech, life sciences, data science/AI, therapeutic care services, hospitality/tourism, creative/performing arts. For each of these sectors:

- Identify a geographic hub for each sector, playing to current strengths while also ensuring that hubs are spread across the country

- Attract the best global talent in each of these sectors to these hubs, and facilitate visas for that talent

- Invest in the UK’s skill base in each hub around the specific sector

- Target financial interventions to support firms in promising clusters

- Reform planning nationwide to boost business and homes in each hub.

- Create a more supportive environment and business culture for scale-ups, with a particular focus on reducing bureaucracy and making public and private sector procurement more favourable.

- Increase funding for schemes like Be the Business to enhance their capacity to provide training and mentoring for leaders of growing companies.

- Remove barriers to university spin outs – by standardising agreements with universities – e.g. at 5% university ownership for professor-led spin-outs and 0% for students, with IP kept by start-up companies.

- Help promote increased ambition in the UK, by showcasing success stories, and celebrating and mentoring entrepreneurship at schools, colleges and universities.

About OakNorth Bank plc

Launched in September 2015 and founded by entrepreneurs, OakNorth is a neobank focused on serving and empowering established businesses that are seeking to scale but are routinely underserved or overlooked by traditional banks: what we call the ‘Missing Middle’.

To date, the bank has provided over £10 billion to these businesses across a wide range of sectors, achieving performance metrics that place it amongst the top 1% of commercial banks globally. Its loans have directly contributed to the creation of 40,000 new jobs, and 29,000 new homes across the UK – the majority of which are affordable and social housing.

It is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

Visit www.oaknorth.co.uk for more information.

Contact

- For media enquiries, please contact press@smf.co.uk

- For OakNorth media enquiries, please contact press@oaknorth.co.uk