After the Government watered down its Renters (Reform) Bill, new research from the Social Market Foundation think tank shows fears that stricter regulations will reduce the supply of rental properties are overblown.

In an international study published today, the Social Market Foundation (SMF) argues that England is an international outlier in terms of the insecurity of its tenants. Compared to similar countries, English rental contracts tend to be relatively short and most comparable countries have ditched ‘no fault’ evictions, if they ever had them.

The SMF says that measures contained in the original draft Renters (Reform) Bill, which promised to end no fault evictions, would have gone some way to improving this situation. Yet after a rebellion from Conservative backbenchers, last week it emerged that housing secretary Michael Gove intends to dilute many of the Bill’s policies which might have protected renters, and delayed plans to end no-fault evictions.

Opponents of the bill argued that the measures are counterproductive because they would lead landlords to exit the market. Yet the SMF’s analysis suggests such worries are overblown:

- Scotland, which banned no fault evictions in 2017, has not seen a significant drop off in rental supply, and instead has seen the number of households in the private rented sector increase.

- Meanwhile, research from Australia has shown that the introduction of greater regulation of tenancies, and protections for renters, has not had an impact on total supply levels.

Outside England, longer tenancies are much more common, and Scotland and the Republic of Ireland have both adopted indefinite tenancies. In Ireland, the policy does not seem to have affected housing supply, despite the warnings of landlords: since the initial legislation was passed in 2004, the private rented sector has doubled in size. The Government’s continued support for rolling tenancies is a step in the right direction.

The SMF’s report, Let down, is the third on an ongoing series, comparing housing policy across English-speaking countries, funded by the Nuffield Foundation. The paper also looks at the controversial issue of rent controls, temporarily introduced by the Scottish Government amidst the cost of living crisis, and favoured by London Mayor Sadiq Khan.

Economic theory suggests caps on rent should discourage landlord investment, leading to shrinking supply and reducing the quality of properties. Yet the SMF find that such policies are nevertheless widespread across Europe, and have more mixed results than the textbooks would suggest.

Rent price regulations – ranging from rent freezes to simply limiting increases on existing tenancies – generally reduce costs for tenants already in housing, but the effect on the availability of properties varies by context:

- Evidence of shortage: Cities like Berlin (rent freeze) and San Francisco (rent capped at 60% of inflation rate) have seen rent regulations lead to a shortage of properties.

- No impact on supply: By contrast, Ireland’s rules, which limit rent increases within ‘rent pressure zones’, have not had a demonstrable negative effect on supply – though more research is needed.

As well as abolishing no fault evictions and moving to rolling tenancies, the SMF recommends strengthening the rent dispute system to make it easier to use. Whereas in England, depending on the complaint, responsibility may lie with the housing ombudsman, local authorities or courts, Australia, New Zealand, Ireland and many Canadian provinces have lead agencies that are a first port of call. Additionally, the think tanks recommends licensing and registering landlords, as is the case in the rest of the UK and Ireland – or creating a non-compliance register, as in Victoria, Australia.

Niamh O Regan, Researcher at the Social Market Foundation, and co-author of the report, said:

“English renters get a bad deal, certainly compared to their counterparts in other countries. Fixed term tenancies are too short, and no-fault evictions make periodic tenancies too risky. What’s more, cash-strapped councils and fragmented dispute resolution services are unable to consistently guarantee minimum standards, allowing bad landlords to continue to operate. Longer tenancies and stronger protections for tenants would alleviate some of the pressures they face and make long term renting a more attractive proposition – which it needs to be, given many of us are likely to be renting for much longer in future.”

Dr Catherine Dennison, Programme Head at Nuffield Foundation, said:

“The next UK government will face a long list of challenges on housing. The SMF’s analysis demonstrates that many potential policy solutions have been tried internationally, and there’s a lot to gain from learning from their experiences. The Foundation is funding this project ahead of the general election, to ensure that political promises are grounded in robust evidence and subject to expert and voter scrutiny.”

Notes

- The SMF report, Let down, will be published at https://www.smf.co.uk/publications/anglosphere-rental-regulations/ on Thursday 4th April.

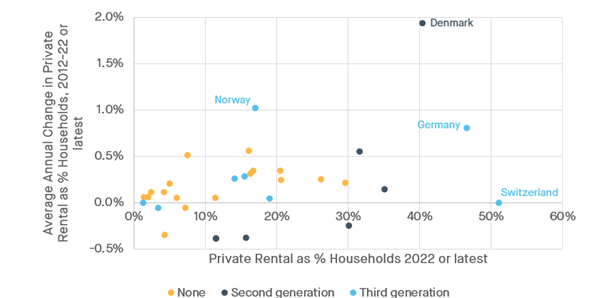

Figure: Share of and change of share of private renting by rental regulation type, 2012-22 or latest year available

Source: Rent regulation in 21st Century Europe comparative perspectives (Kettunen and Ruonavaara, 2020), EUROSTAT, OECD, UK Census data, Stat NZ, StatCan, ABS

- The Nuffield Foundation is an independent charitable trust with a mission to advance social well-being. It funds research that informs social policy, primarily in Education, Welfare, and Justice. The Nuffield Foundation is the founder and co-funder of the Nuffield Council on Bioethics, the Ada Lovelace Institute and the Nuffield Family Justice Observatory. The Foundation has funded this project, but the views expressed are those of the authors and not necessarily the Foundation. Website: nuffieldfoundation.org Twitter: @NuffieldFound

Contact

- For media enquiries, please contact press@smf.co.uk

ENDS