The UK is the card fraud capital of Europe – most victims per 1000 people and the losses are highest, a think tank says today.

Britons suffer far more card frauds than people in any European country. UK losses from card fraud are also much higher.

This is revealed in SMF analysis of European Central Bank data, as demonstrated by the following charts.

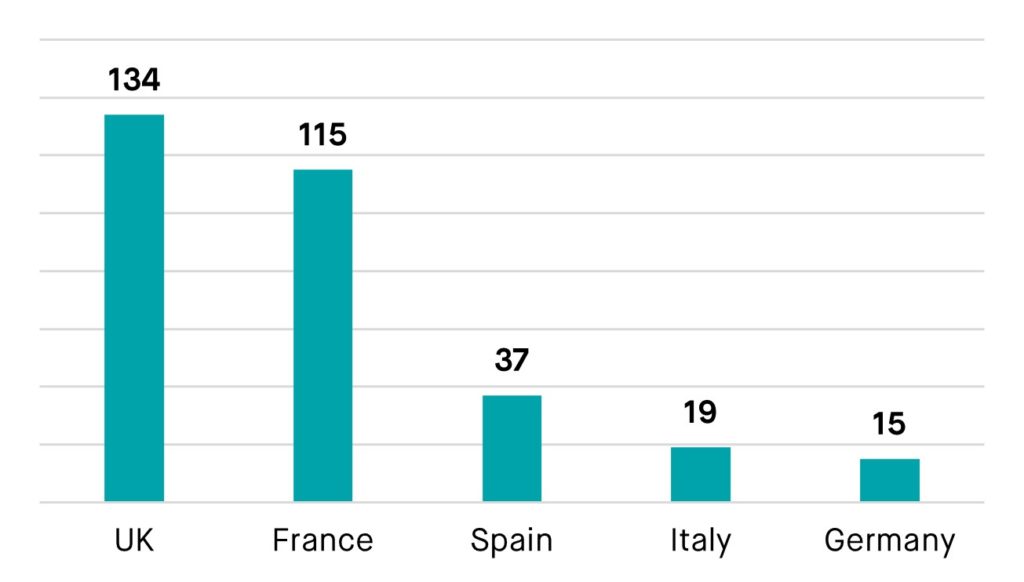

Figure 1: Number of card frauds per 1000 people in major European countries

Source: European Central Bank

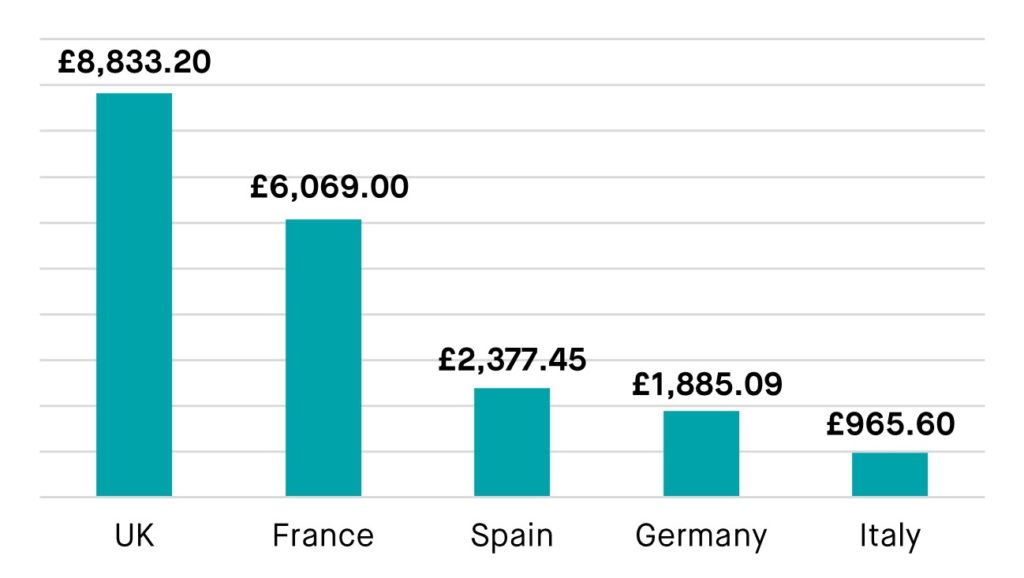

Figure 2: Cost of card fraud per 1000 people in major European countries

Source: European Central Bank

The SMF has called on the Government to adopt a “comprehensive whole-systems” approach to address fraud – Britain’s dominant crime – starting with recruiting more specialist staff that are trained to handle complex crime like fraud (and other economic crime types).

Richard Hyde, SMF Senior Researcher, said:

“Britain’s shocking record on card fraud compared to major European economies is yet another reminder of how UK law enforcement has failed to keep up with the epidemic. Policymakers need to reflect further on why we’re at this stage.

“Solving the crisis will take more than just increased police staff. Whilst specialist staff will certainly play a crucial role, the entire fraud law enforcement landscape needs an overhaul – with reforms that will transform the system and enact lasting change.

“There is no time to delay – fraud and economic crime is evolving to be more difficult to investigate and solve – so policymakers must start to make comprehensive system changes now.”

Notes

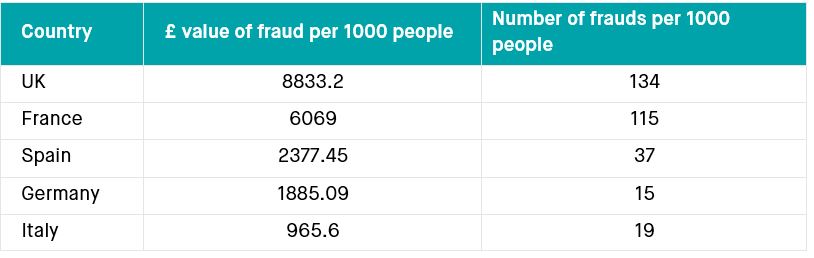

Annual figures shown in the chart below:

- Data on cards, inhabitants, transactions per card and transactions per inhabitant are taken from the ECB Statistical Data Warehouse (SDW). ECB data on fraud and fraud per transaction were collected by all reporting card payment scheme operators for 2019

- Data covers the three forms of card fraud: Card-Not-Present (CNP) fraud, where your card number is used for a purchase; Point of Sale fraud, where your stolen/cloned card is used to buy something; and ATM fraud, where your stolen/copied card is used to withdraw cash. CNP fraud was 84% of all UK card fraud, so the overwhelming majority of UK card fraud is people having their card numbers used without their knowledge/consent.

- £ values for fraud were stated in 2019 Euros in the original ECB data. We’ve converted them to GBP here using today’s exchange rates.

- For recent SMF work on fraud, please see https://www.smf.co.uk/commentary_podcasts/fraud-is-britains-dominant-crime/

Context on Card Fraud:

There are several different measurements of the scale of card fraud, all yielding slightly different data that aren’t directly comparable. But all sources suggest that card fraud is roughly half of all fraud activity, and therefore the single most common form of fraud.

The City of London Police (E&W’s lead force for fraud) said that “cheque and card fraud” was the most frequently reported type of fraud (through Action Fraud) in 2020-21, with 336,770 reports.

Card fraud is 45% of all fraud losses, according to UK Finance. (UK Finance also estimate that the total number of instances (cases) of fraud on UK issued cards was 2,835,622 in 2020, up from in 2016, when there were 1,820,726 instances (cases).

According to the Crime Survey for England and Wales, between April 2021 and March 2022 there were 2.3 million “bank and card frauds”, 1.4 million “consumer and retail frauds”, 599,000 “advance fee frauds” and 245,000 “other frauds”. “Bank and card frauds” are 51% of the total recorded frauds committed against residents of E&W and recorded by the CSEW.

Contact

For media enquiries, please contact press@smf.co.uk