Nearly six in ten (57%) people say tech giants – like Meta and TikTok – should share responsibility for reimbursing fraud victims with banks and building societies as ‘fraudemic’ sees one in ten targeted.

The finding comes from a report published today by the Social Market Foundation (SMF) think tank, sponsored by Nationwide Building Society, providing new evidence about the impact of fraud on victims, and mapping out a 13-point plan to tackle the issue.

The SMF found that 57% of people support making digital platforms reimburse victims of fraud on their platforms, rising to 64% among fraud victims. The report also highlights that close to one in ten (9%) of the UK’s population fell victim to fraud in 2021-2022, in what the SMF refer to as a ‘fraudemic’.

It comes with the Government under pressure to make tech giants compensate fraud victims and bear some of the losses, in addition to banks and building societies. Yet the Payments Systems Regulator plans only to hold sending and receiving banks or building societies liable as things stand. The Online Safety Bill, which is making its way through Parliament and will soon become an Act, has provisions to make tech companies responsible for hosting scams and fraudulent content, but does not mention any responsibility for helping compensate victims.

But it isn’t just tech companies people believe need to up their game, as nearly three-fifths (58%) think the government are doing “less than enough” in their current efforts to address fraud.

The report is sponsored by Nationwide Building Society. The SMF retains full editorial independence.

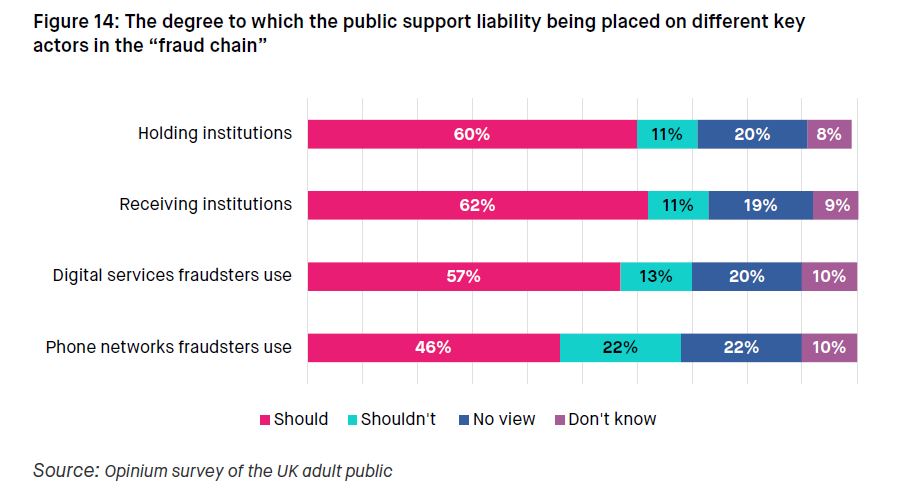

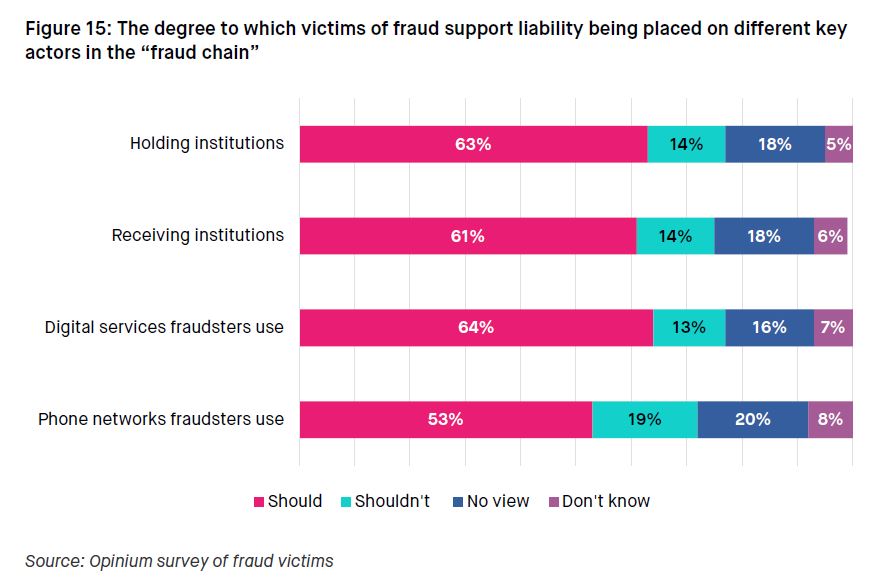

The SMF polling on whether different private sector actors in the ‘fraud chain’ – the stages of the crime, from identifying a victim to securing victim’s assets – should be responsible for compensation showed that digital platforms were held the most responsible (64%), followed by the holding institution (63%), receiving institution (61%) and phone networks (53%). (See notes)

The SMF is calling for other organisations in the “fraud chain” to be made eligible to pay some of the reimbursement costs.

The SMF’s polling also found majority (70%) support for the introduction of more verification and checks into the payments system e.g, when money transfers between banks or building societies. When asked about future scenarios where new verification tools were developed to substantially lower fraud risk with the caveat that those tools may slow down payment and transfers further, 54% were in support, rising to 64% among fraud victims.

SMF’s 13 recommendations are aimed at increasing the responsibility for the private sector to both avoid frauds occurring in the first place and compensating victims. They include the following (full list of recommendations in the Notes):

- Increasing punishment for convicted fraudsters to deter criminals.

- Ensuring adequate reimbursement for victims and support for those who are vulnerable.

- Extending reimbursement beyond banks and building societies to include big tech.

- Building collective resolve through enhanced data sharing within the ‘fraud chain’.

- Enhancing friction for payments to enable deeper checks on senders and receivers.

Richard Hyde, SMF Senior Researcher, said:

“Despite the substantial detriment, political debates over crime often ignore the fraud threat – perhaps because it is less visible than other types of crime. But our research has shown the depth of suffering caused and how it is only becoming more pervasive in our society.

Preventing and giving victims proper support will require more effort from every actor in the ‘fraud chain’ to strengthen their checks and take responsibility for compensating victims.”

Jim Winters, Director of Economic Crime at Nationwide Building Society, said:

“Social media has become fertile ground for scammers, with controls seemingly yet to catch up with other industries, allowing criminals to all but freely target victims across their platforms. We will continue to reimburse those who have had their money taken through no fault of their own, but we need social media platforms, and other industries where scams start, such as big tech and telecoms to take more responsibility for reimbursement. We need a joint approach whereby social media platforms work with telecoms, financial services and government to stop fraud at the outset – not just after the criminals have struck. That can only be done by the seamless sharing of data and information between sectors.”

Notes

- The SMF report, The view from the ground, will be published at https://www.smf.co.uk/publications/fraud-view-from-the-ground/ on Thursday 14th September, 2023.

- A holding/receiving institution is a financial institution where consumers store their money – like a bank or building society.

- Details of research:

- The SMF conducted two surveys. The first is a nationally representative survey of more than 2,000 UK adults. The second is a specific survey of more than 500 British people who were fraud victims in the period 2020 to 2023. Both surveys were in the field between late April and early May 2023.

- In-depth, semi-structured interviews with 10 members of the UK public from a wide range of different earnings cohorts, working in a variety of occupations and spanning the adult age spectrum i.e. participants included people in their twenties through to people in their seventies. Seven interviewees were recent fraud victims and three were not. The latter acted as a small control group and met the criteria of being of average age and on average incomes.

- The report is sponsored by Nationwide Building Society. The SMF retains full editorial independence.

- Full list of recommendations:

- Recommendation 1: Help improve politicians’ and policymakers’ understanding of the fraud threat with a specific multi-year, funded research programme.

- Recommendation 2: Reform fraud reporting to close the “reporting gap”.

- Recommendation 3: Under the auspices of the Consumer Duty, best reimbursement practices should be developed by the regulator, alongside a requirement for relevant financial institutions to systematically integrate access to official victim support services with the reporting and reimbursement of frauds.

- Recommendation 4: Develop a robust standard methodology for capturing more definitively the differential impact fraud has on a victim’s economic circumstances and the wider psychological and social costs that can accrue.

- Recommendation 5: Toughen the sentencing of convicted fraudsters with reforms to the rules so that they take into account the wider impacts that victimisation has on individuals and also reflect the scale and cost of the current fraud epidemic.

- Recommendation 6: Establish an arrangement, similar to the Criminal Injuries Compensation Authority scheme for providing short-term financial support for victims of serious physical crimes, for vulnerable fraud victims.

- Recommendation 7: Banks, building societies, credit card providers and other payment services firms that reimburse fraud victims should evaluate their reimbursement offers to ensure they meet high customer services standards, and they are especially sensitive to vulnerable customers who have been fraud victims.

- Recommendation 8: Start the process of developing a new set of policy proposals, for introduction in 2025, for improving the coordination of the fraud response by solving the collective action problems. These should include the measures proposed in recommendations 10, 11, 12 and 13.

- Recommendation 9: Prioritise the fraud threat with new investment in the capacity and capability law enforcement and criminal justice system.

- Recommendation 10: Continue with the PSR’s reimbursement plans to share liability between sending and receiving institutions and prepare for a second phase, where other organisations in the ‘fraud chain’ are made eligible for some of the costs of reimbursement.

- Recommendation 11: Introduce more “frictions” into the payments system by placing stronger obligations on financial services firms in the “fraud chain” to lower fraud risks for customers so that there is greater assurance over the legitimacy of payments and transfers, including the provenance of senders and receivers of payments and transfers.

- Recommendation 12: Develop a more extensive and deeper data sharing arrangement across the organisations that are part of the ‘fraud chain’ and between the private sector and appropriate parts of the public sector.

- Recommendation 13: Set-up a national ID protection service to help reduce the risk of ID related fraud.

Contact

For media enquiries, please contact press@smf.co.uk